Solis Minerals Ltd (ASX:SLM, TSX-V:SLMN, OTCQB:SLMFF) has signed a binding agreement to acquire the Jaguar Lithium Project in Bahia state, Brazil which has confirmed spodumene grades of up to 4.95% Li2O (lithium oxide) from rock chip samples.

The Jaguar pegmatite is an extensive pegmatite body mapped over 1 kilometre of strike, with widths in excess of 50 metres containing coarse visible spodumene exposed across the pegmatite body.

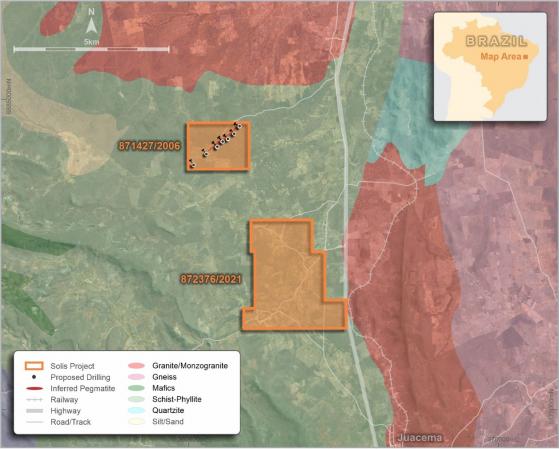

The project tenements cover a combined area of 1,143 hectares and are located 86 kilometres from Petrolina and Juazeiro, two major regional cities on the San Francisco River.

Location map showing infrastructure and tenements acquired at the Jaguar project.

Solis executive director Matthew Boyes said: “Brazil is fast becoming a significant player in the hard rock lithium space.

“Solis’s primary objective is to quickly position itself by acquiring highly prospective underexplored projects in the northeast of Brazil.”

A series of surface samples were collected from the exposed portion of the Jaguar pegmatite within an artisanal open pit or ‘Garimpo’.

Samples were taken from the spodumene-rich pegmatite quartz core primarily to confirm the grade of the visible spodumene mineralisation.

Results of grab samples taken from the Jaguar artisanal working.

A field campaign will start in the coming weeks to complete systematic geochemical sampling of all the known outcrops plus mapping and target generation for follow-up drill programs; Solis has secured a drill rig and plans to start drilling in June.

Large white weathered spodumene crystals within Jaguar artisanal workings.

Boyes added: “The Jaguar pegmatite hosts confirm LCT-bearing pegmatites with some of the coarsest and most abundant spodumene occurrences I have seen.

“These tenements in what may be a new lithium province are a fantastic addition to our already large tenement position in the northeast of Brazil, and with drilling to commence immediately, I am excited by this opportunity to better understand the potential of this very exciting system.”

Tenement map with satellite image and mapped pegmatite body with proposed drill hole locations.

The consideration for the acquisition includes an upfront option fee of USD$300,000, an option exercise fee of USD$700,000 and a deferred consideration fee of USD$2,900,000 payable within 12 months from option exercise.

Solis’ largest shareholder, Latin Resources Ltd (ASX:LRS, OTC:LRSRF), which is advancing the Salinas Lithium Project in Brazil, will provide exploration guidance and insights derived from its extensive experience in the country.

Read more on Proactive Investors AU