Japanese tech investment titan SoftBank’s yearly earnings report is expected Thursday, with the performance of British semiconductor designer Arm Holdings taking centre stage.

Although SoftBank executives “are unlikely to offer meaningful new information about the Arm listing”, according to an analysis in Reuters today, the filings will provide key insights in other ways.

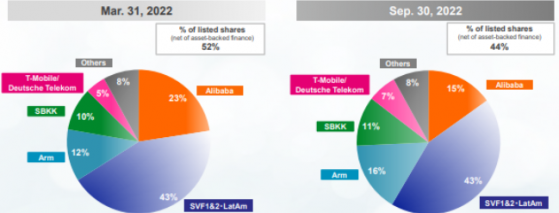

SoftBank’s investment in Arm has grown in relation to its combined net asset value (NAV) from 12% to 16% in the past three quarters, thanks largely to a paring down of SoftBank’s equity holdings in Alibaba (NYSE:BABA).

SoftBank’s strategic realignment away from the Chinese e-commerce giant towards Arm is likely to ramp up as IPO negotiations continue, so the extent to which SoftBank’s semiconductor gamble comprises its wider portfolio will be a key metric of concern for investors.

Given the extent to which SoftBank’s future is increasingly resting on Arm’s shoulders, the British chip designer’s revenues will undoubtedly be front a centre.

This shouldn’t be too worrisome for SoftBank; Arm chip designs wield 95% of the market share in the smartphone space after all (plus around 63% in the internet-on-things space, 24% in automotives and a bonus 5% in cloud computing).

Source: SoftBank

Taking Arm public could prove to be something of a double-edged sword for SoftBank.

On the one hand, it is SoftBank’s clearest avenue to a significant cash injection following four consecutive quarters of investment losses. In the most recent quarterly update, SoftBank’s cash position fell from 4.3 trillion yen to 3.8 trillion yen (£25bn to £22bn).

However, hitting the IPO valuation target will only widen SoftBank’s discount to NAV, although this could present a good buying opportunity should you see this discount as unjustified.

The equity value of SoftBank’s 75% ownership of Arm was £15.5bn at the latest count, while the IPO is seeking a valuation anywhere between £40bn to £50bn.

Even at the lower end of the valuation spectrum, the IPO will widen the valuation gap.

Softbank’s market value took a pummeling in March due to its exposure to the collapsed Silicon Valley Bank, with nearly £5bn wiped from the share price, further adding to its considerable discount.

It has since recovered around half of these losses.

SoftBank is also facing a critical deadline to take Arm public.

If no IPO is formally filed or a flotation does not go ahead by the end of September, Arm could become liable for US$8.5bn of debt taken out against its shares by SoftBank under a springing guarantee naming Arm as the guarantor.

SoftBank’s full-year 2022 results are expected on Thursday, May 11.

Read more on Proactive Investors AU