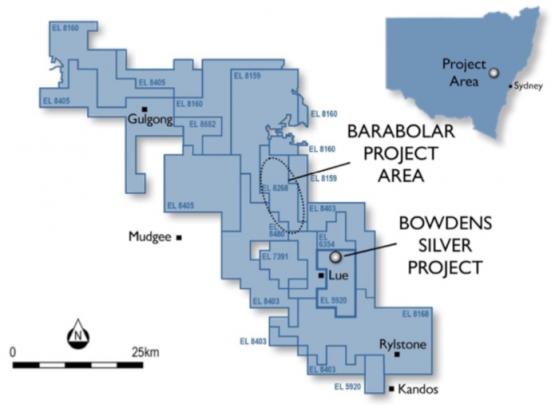

Silver Mines Limited (ASX:SVL) (ASX:SVL) (OTCMKTS:SLVMF) (FRA:SWQ) is on the path to production at its Bowdens Silver Project pending approval of its Environmental Impact Statement from the New South Wales Department of Planning, Industry and Environment (DPIE).

The proposed Bowdens Silver development in the New South Wales Central West comprises an open-cut mine feeding a new processing plant with a conventional milling circuit and differential flotation to produce two concentrates that will be sold for smelting off-site.

Plant capacity is designed for 2 million tonnes per annum with a mine life of 16.5 years.

Life of mine production is expected to be around 66 million ounces of silver, 130,000 tonnes of zinc and 95,000 tonnes of lead.

Expanded drilling program

Managing director Anthony McClure said the company planned to expand drilling activities at Bowdens with up to 20,000 metres targeting high-grade infill and extension silver mineralisation.

“We have two rigs on-site at the moment drilling this out and we’re looking at mobilising a third rig in shortly.”

Diamond drilling continues to test extensions of potential source/feeder structures within and around the Northwest High-Grade Zone which has recently returned high-grade results of:

- 34.6 metres at 471 g/t silver equivalent (413 g/t silver, 1.14% lead and 0.39% zinc) from 96 metres which includes:

- 7.0 metres at 1,090 g/t silver equivalent (966 g/t silver, 2.86% lead and 0.56% zinc) from 97 metres; and

- 6.1 metres at 874 g/t silver equivalent (789 g/t silver, 1.67% lead and 0.59% zinc) from 122 metres.

Underground mining potential

The Northwest zone starts around 30 metres below the base of the proposed Bowdens Silver open pit and is being targeted for potential high-grade silver underground mining scenarios.

McClure said that over the next 12 months the company was aiming to have a resource assessment and to scope out a potential underground high-grade operation.

“The close-to-surface orebody is effectively drilled out and well understood, however, we’ve been drilling directly underneath where the open pit will be and into new areas of mineralisation and we’ve been returning spectacular results.”

“Previously, there has been very little work done at depth, and it’s still very much a developing exploration project but we have clearly demonstrated a massive mineralised system.

"With the current drilling, a significant expansion of the resource is highly likely”, McClure added.

Bullish silver market outlook

As the only substantial silver stock on the ASX, the company is confident that its Bowdens Silver Project will be well-placed to take advantage of a strong long-term outlook for silver.

McClure said, “We have a project that is well advanced, has been de-risked and is now into the final approvals process with production in an upwelling silver price environment. That’s a perfect storm for us.

"The outlook for silver is particularly positive which is currently resulting in a lack of physical silver metal in the market. However, development of silver’s industrial applications is increasingly being investigated.

“Silver is the best electrical conductor of all the metals. That’s why silver is in every mobile phone, every TV and almost every electronic device has silver in it. The future Electric Vehicle (EV) market is very substantial.

“Those markets are expanding as the world gets wealthier and third-world countries continue to develop at an increasing rate – so it’s a really bullish end of the market.

“Silver is also a component of photovoltaic cells for solar panels, is used in some medical applications, nanotechnologies, and water purification - all of which are technologies in growth industries. This bodes well for silver’s long-term outlook."

Well-funded going forward

The company’s recent $30 million placement means it will be well-funded to progress the pre-development of the Bowdens Silver Project.

Funding will also be used for exploration activities over the coming 12 months and for corporate and general working capital purposes as required.

“Our financial position allows us to expand exploration efforts,” McClure added.

“The open-cut development will, of course, go ahead, however, if in years three or four of that mine development we’re opening up an underground operation supplementing the ore feed with high-grade material, that will be a very significant material benefit for the mine.

“It’s worth noting that over the past 12 months, the number of shareholders has increased from around 4,500 to more than 12,000. That’s extraordinary for a company of this size.

"That shareholder growth over a short period of time is highly encouraging and provides solid liquidity in the market. This is particularly attractive for investors.”

Read more on Proactive Investors AU