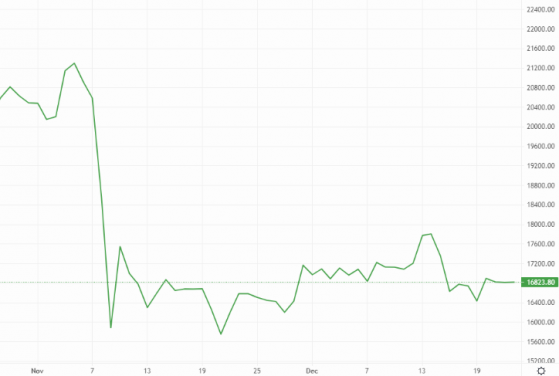

Bitcoin (BTC) seems to have packed it in for Christmas, given the exceptionally low trading volumes and minimal price movement on the BTC/USDT pair.

Given the lack of investor appetite, BTC/USDT has barely moved from the US$16,800 price point since the start of the week.

If the bears do kick into gear, we could expect a downside to US$16,500, while bullish momentum could see a return to US$17,000.

Bitcoin (BTC) certainly didn’t sleigh this Xmas – Source: currency.com

As for Ethereum (ETH), it remains affixed to the US$1,210 to US$1,220 range, with a flat US$1,200 seen as the logical bearish move.

Headline digital assets face a fresh macro challenge: The US economy seems to be more resilient than first expected.

Gross domestic product growth substantially outperformed forecasts in yesterday’s reading, potentially hampering a return to risk-on assets.

Yet a couple of large-cap altcoins have piqued investors’ interests in the past day.

Cardano (ADA) is up over 5% from yesterday’s intraday low, as is the Dogecoin (DOGE) meme coin.

Other top risers today include Axie Infinity (AXS), NEAR Protocol and Decentraland (MANA).

Taking the low road, internet-of-things project Helium (HNT) dipped over 11% following yesterday’s surprise rally, while Toncoin (TON) and privacy coin Zcash (ZEC) are also lagging.

Across the week, global cryptocurrency market capitalisation has fallen by 2%, where it currently stands at US$811bn.

It seems like Santa didn’t have a rally on the shopping list for the markets this year, but investors are still left holding the bag.

Sam Bankman-Fried’s favourite carol? Surely it’s I’ll be home for Christmas

One man who will be home for Christmas is Sam Bankman-Fried, who has been bailed out of jail on a US$250 bond following his extradition from The Bahamas.

Under the bail agreement, Bankman-Fried will be monitored via an ankle bracelet and has had to surrender his passport.

He has also agreed to regular mental health and substance abuse checks.

But the Christmas miracles probably end there for the former head of cryptocurrency exchange FTX, who faces life behind bars if found guilty of multibillion-dollar criminal fraud charges.

Like Jacob Marley, the ghost of SBF’s past haunts him in the form of former girlfriend and business associate Caroline Ellison, who has agreed to testify against her once lover.

Read more on Proactive Investors AU