Novice investors often overlook the pivotal importance of having top-of-line value stocks in their portfolios when the market is thriving. However, when times get tough, they are the first ones to look for solid companies with strong, globally recognizable brands and exceptional financial metrics.

Sadly, oftentimes, that's already too late to find such gems at a reasonable price.

In fact, the importance of the value concept in the world of finance is so pivotal that, as Warren Buffett himself would argue, every good investment should be considered a "value" investment:

"Price is what you pay. Value is what you get."

To guarantee you will never miss the value boat again, our 'Top Value Stocks' strategy employs advanced AI models to identify up to 20 U.S.-listed stocks each month that are undervalued yet possess solid earnings and are primed for growth.

These companies are typically trading at prices lower than their perceived intrinsic value, presenting them as potentially significant bargains for investors.

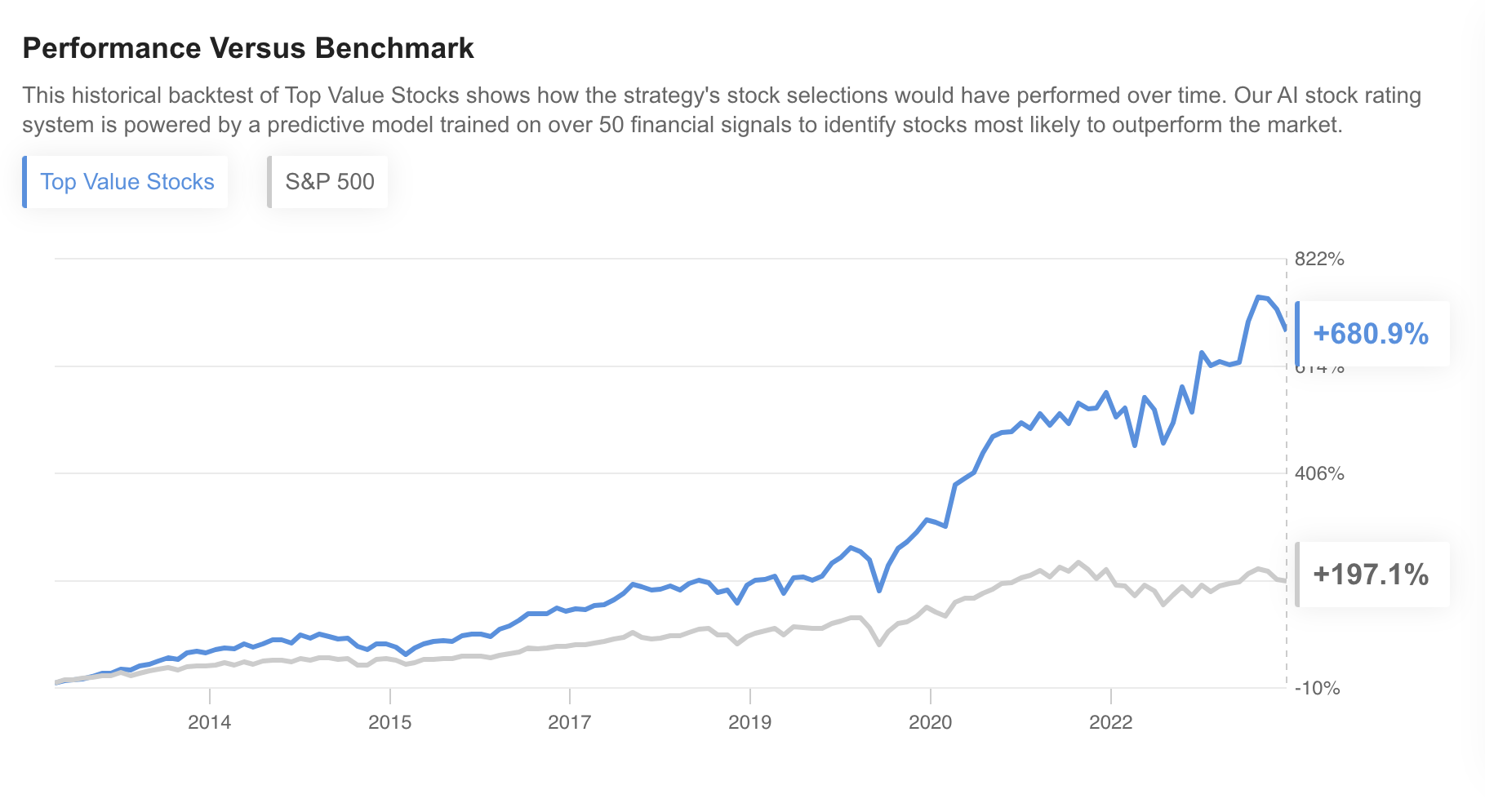

Historical data shows that our strategy would have beaten the S&P 500 by 567% over the last decade while keeping a relatively low risk exposure, as seen in the chart below: Source: InvestingPro ProPicks

Source: InvestingPro ProPicks

Let's take a deeper look at three of the stocks highlighted within the strategy as of now, namely: United Therapeutics, eBay, and Expedia (NASDAQ:EXPE), which are covered below in detail.

InvestingPro users can see the full strategy - along with the other five ProPicks strategies - on our ProPicks gallery page.

Not yet a Pro user? Subscribe now for an up to 60% discount for limited time only as part of our Extended Cyber Monday Sale!

*Readers of this article can enjoy an exclusive 10% discount on our annual Pro+ plan with coupon code Value1, and a similar discount of 10% on the bi-yearly Pro+ plan by using coupon code Value2 at checkout!

1. United Therapeutics (UTHR)

- InvestingPro Health Label: Great

- InvestingPro Fair Value: Undervalued (27.0% Upside)

- Forward P/E Ratio: 12.6x

- Dividend Yield: 0.0%

United Therapeutics (NASDAQ:UTHR), a biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Shares are up 7.4% in the past month and down 13.4% year to date.

What do Wall Street analysts say?

According to analysts surveyed by InvestingPro, United Therapeutics is Fairly valued with 24.6% Upside.

Earlier this month, UBS initiated coverage on United Therapeutics with a Buy rating and a price target of $320, citing Tyvaso diversified growth ahead, Remodulin stabilizing. The firm commented:

UTHR stock has doubled in last 2 years, but we continue to see meaningful upside ahead. 1) UTHR's Tyvaso is a foundational therapy for Pulmonary Arterial Hypertension (PAH); Tyvaso's transition into newly launched dry powder inhaler (DPI) format & expansion into PH-Interstitial Lung Disease (PH-ILD) fuels growth.

Key recent news

In November, United Therapeutics reported Q3 earnings of $5.38 per share on revenue of $609.4 million. Analysts were looking for $5.15 earnings on revenue of $587.9M.

In October, United Therapeutics and Miromatrix Medical (NASDAQ:MIRO) announced a definitive agreement for United Therapeutics to acquire Miromatrix, a life sciences company focused on the development of bioengineered organs composed of human cells.

2. eBay (EBAY)

- InvestingPro Health Label: Good

- InvestingPro Fair Value: Undervalued (35.8% Upside)

- Forward P/E Ratio: 8.0x

- Dividend Yield: 2.4%

eBay (NASDAQ:EBAY) operates marketplace platforms that connect buyers and sellers in the United States and internationally.

Shares are up 8.4% in the past month and 2.9% year to date.

What do Wall Street analysts say?

According to analysts surveyed by InvestingPro, eBay is Fairly valued with 7.8% Upside.

Most recently, in October, Stifel initiated coverage on eBay with a Hold rating, writing:

"We believe EBAY is taking the right approach, with a focus on key categories (which outpace corporate-level GMV growth), but we need to see improvement in the buyer base (and Enthusiast Buyers) and evidence that GMV is poised to show accelerating growth to be more positive on shares."

Key recent news

In November, eBay reported Q3 earnings of $1.03 per share on revenue of $2.5 billion. Analysts were looking for $1.00 earnings on revenue of $2.5B.

3. Molina Healthcare (MOH)

- InvestingPro Health Label: Great

- InvestingPro Fair Value: Undervalued (31.4% Upside)

- Forward P/E Ratio: 22.7x

- Dividend Yield: 0.0%

Molina Healthcare (NYSE:MOH) provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Shares are up 7.6% in the past month and 9.8% year to date.

What do Wall Street analysts say?

According to analysts surveyed by InvestingPro, Molina Healthcare is Fairly valued with 0.8% Upside.

Most recently, in June, UBS analyst Kevin Caliendo initiated coverage on Molina Healthcare with a Neutral rating and a price target of $310.00.

Key recent news

In October, Molina Healthcare reported Q3 earnings of $5.05 per share on revenue of $8.55B. Analysts were looking for $4.88 earnings on revenue of $8.24B.

Subscribe now to see all the the picks and follow the 'Top Value Stocks' strategy!

*Readers of this article can enjoy an exclusive 10% discount on our annual Pro+ plan with coupon code Value1, and a similar discount of 10% on the bi-yearly Pro+ plan by using coupon code Value2 at checkout!