Richmond Vanadium Technology Ltd (ASX:RVT) has the financial muscles to unlock the potential of its world-class Richmond-Julia Creek vanadium deposit in North Queensland to create a new industry for Australia.

The project hosts one of the largest undeveloped oxide vanadium resources in the world, with a mineral resource of 1.8 billion tonnes at 0.36% for 6.7 million tonnes of vanadium pentoxide (V2O5).

RVT is in the midst of completing a bankable feasibility study (BFS) and an Environmental Impact Statement (EIS) for the project, along with an Environmental Authority and Progressive Rehabilitation and Closure Plan to support a future Mining Lease grant.

Completion next year

The BFS commenced in June last year with the appointment of DRA Global as the engineering services consultant and Epic Environmental as lead consultant for the EIS.

Prior to that, extensive geological, mineralogical and metallurgical test work had already been conducted since early 2023 at four laboratories in China and Australia.

Following a detailed review of initial results from all the work programs and the current vanadium market, the BFS is now expected to be completed in the June quarter of 2025, with regulatory approvals and a final investment decision likely in the September quarter of the same year.

Creating a new industry

“Richmond Vanadium Technology is focused on contributing to the creation of a new industry for Australia, the development and global implementation of vanadium redox flow batteries,” Richmond Vanadium managing director Jon Price said.

“We need to ensure we have the technical, ESG and financial assessment capabilities, as well as the expected rise in vanadium price to take advantage of the forecast growth in demand for grid-scale energy storage in 2026 and beyond.

“To enable a new industry from raw material to end user product, all levels of government, the investment community and all Australians need to get behind the vanadium sector to make it a global player.

“RVT has a strong balance sheet and is fully funded up to an investment decision next year. We look forward to keeping all stakeholders fully informed as we progress the BFS and approvals according to this updated timeline.”

Busy period ahead

The company has completed a detailed geological and mineralogical assessment across the Richmond-Julia Creek deposit and identified variability within the ore zones that requires further work.

Vanadium grades have remained consistent, both along strike and at depth.

In the next 18 months, RVT will focus on completing the following:

- Continuation of extensive metallurgical test work at both laboratory and pilot plant scale;

- Further infill drilling, mineralogical and geological modelling;

- Updated mine design, economic evaluation and Mining Lease application;

- Refinement and optimisation of the concentrator and recovery plant flow sheets;

- Securing key infrastructure and services including power, water, reagents and labour;

- Detailed process design, engineering, equipment lists and tender packs;

- Updated capital and operating costs and assessment of locations for plant infrastructure;

- Baseline environmental monitoring and EIS preparation; and

- Vanadium market assessment and negotiation with potential offtake partners and financiers.

Where it stands now

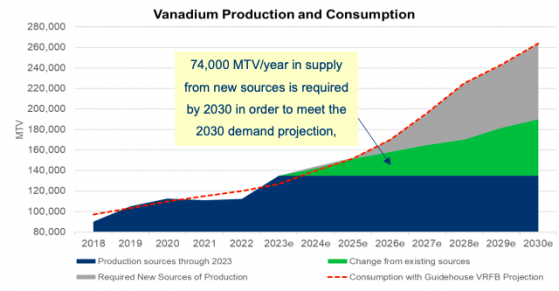

The global vanadium supply chain is currently dominated by China, Russia and South Africa, which collectively produce about 135,000 tonnes annually.

Historically, the primary driver of demand has been the steel and specialty alloy industry, accounting for more than 90% of vanadium consumption.

The emergence of vanadium redox flow batteries (VRFBs) in mainstream applications, such as for stabilising existing power grids and storing renewable energy, is expected to drive future demand growth.

However, current and potential vanadium sources are projected to fall short by 74,000 tonnes per annum from 2026 onwards.

Australia, which is currently not a producer of vanadium but hosts the third largest resource globally, stands to potentially become a major player in the future of vanadium supply.

Projected supply shortage to meet future demand (Source: TTP Squared; Guidehouse Insights).

Read more on Proactive Investors AU