Gaining prominence in vital applications ranging from smartphones and electric vehicles to wind turbines and medical treatments are rare earth elements (REEs), a group of 17 critical minerals essential for modern technology and decarbonisation goals.

The global supply chain of REEs is highly concentrated in a few geographic areas, leading to economic vulerabilities and geopolitical concerns - primarily because of the use of these minerals as "economic weapons".

The demand for these critical materials in emerging technologies, coupled with supply chain complexities and environmental considerations, makes REEs a significant focus in contemporary materials science, industry and international relations.

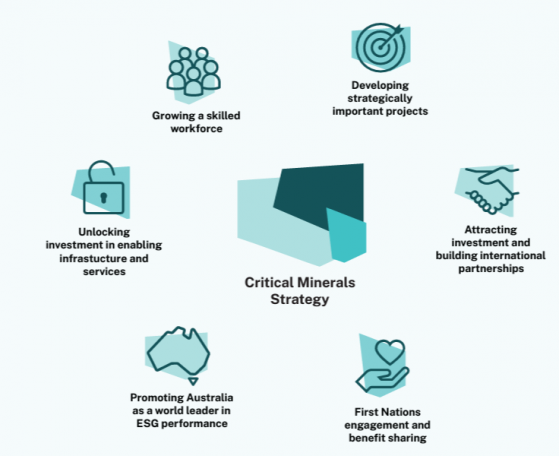

Amid this, Australia's new Critical Minerals Strategy is spearheading the drive to maximise the nation's benefits across its internationally significant critical minerals endowments.

Extensive public consultation identified 6 areas to focus on to achieve the Australian Government’s goals for the critical minerals sector.

Australia’s role in global demand

Global demand for rare earth elements is projected to soar to 315,000 tonnes by 2030, spurred largely by the shift towards clean energy technologies like electric vehicles, wind and solar power.

Australia is the fourth-largest producer of REE in the world, with an annual capacity of 24,000 tonnes, has experienced remarkable growth from a meagre 1,995 tonnes in 2011.

Recognising the need to reduce over-reliance on China in downstream capacities, which includes manufacturing of permanent magnets and end-products, efforts are being made to expand this part of the supply chain.

The Australian government has actively supported the REE industry, investing A$30 million as part of a larger A$240 million investment to lessen dependence on China, as part of its critical minerals strategy.

This support is indicative of the strategic importance of the REE industry to Australia's economic and technological future.

Following are the REE juniors that shone during the June quarter:

American Rare Earths

American Rare Earths Ltd (ASX:ARR, OTCQB:ARRNF) remains on a positive trajectory during the June quarter upon achieving significant milestones as it transitions into the United States and advances drilling at its flagship project at Halleck Creek.

The highlight of the quarter is the company’s upgrade to the OTCQX market in the US, the top tier of the OTC Markets, and making an application to list on NASDAQ.

In the US, ARR has also kicked off the process for board renewal and skill enhancement with the recruitment of suitably qualified US mining professionals and ultimately the appointment of a US-based chair.

At Halleck Creek, the company applied for a permit to drill up to 31 holes and plans to drill at least 2,400 metres, expected to kick off in the September 2023 quarter.

During the quarter, metallurgical test work continues to show that a simple process flow sheet can produce a rare earth concentrate and maximise the recovery of magnet metals.

Meanwhile, internal studies are examining annualised ore processing rates of 10, 15, and 20 million tonnes per annum feed rate to the concentrator, as the company aims to establish optimal project economics.

Australian Strategic Materials

Australian Strategic Materials Ltd (ASX:ASM) executed its business priorities during the June quarter with a specific emphasis on safety, quality, and strategic growth across its rare earth interests in Korea and Australia.

During the quarter, the company embarked on a strategic partnership with US-based rare earth magnet manufacturer Noveon Magnetics Inc, with the sale of an initial 100 tonnes of NdFeB alloy from ASM’s Korean Metals Plant (KMP).

In a move to ensure the uninterrupted ramp-up of production at the KMP, ASM also secured the supply of rare earth oxides with Vietnam Rare Earth Company, reflecting a significant commitment to operational continuity and efficiency.

Progress was also made in the diversified funding strategy for the Dubbo Project with the company being awarded a $6.5 million grant under tranche two of the Australian Government's Critical Minerals Development Program.

In a bid to improve safety and quality across its operations, ASM was awarded ISO 45001 (OHS Management System) accreditation, and the Daejeon Regional Office of the Ministry of Employment and Labour recognised it as an industry leader for the risk assessment practices implemented at the KMP.

The quarter's activities underscore ASM's determination to lead in the industry, underpinned by strategic partnerships, a focus on sustainable supply chains, and adherence to world-class safety and quality standards.

Ionic Rare Earths

The June quarter marked significant growth and development for Ionic Rare Earths Ltd (ASX:IXR, OTC:IXRRF), spearheaded by advancements at the Makuutu Rare Earths Project in Uganda and initiatives at Ionic Technologies in Belfast, UK, shaping a robust trajectory for the company.

The company’s corporate capability continued to expand with strategic additions to the board to progress supply chain engagement in the EV sector, and the appointment of an experienced African mining executive to the position of chief operating officer accelerated growth at Makuutu.

During the quarter, engagement with various stakeholders and potential strategic partners continued to advance, reflecting the unique appeal of the Makuutu basket of magnet and heavy rare earths, as well as separated magnet rare earth oxides (REO) from Ionic Technologies.

The Makuutu Rare Earths Project saw IonicRE's ownership move to 60% and the company has the first right over the remaining 40% stake in Rwenzori Rare Metals and Makuutu.

At the field, 76 rotary air blast (RAB) holes were drilled, and infill diamond drilling at RL00007 was approved with the construction of a demonstration plant kicking off, along with strong community engagement support with the project's potential to become Uganda's flagship mine.

At Ionic Technologies, the Belfast Demonstration Plant achieved its first production of high-purity magnet rare earth oxides (REO) from spent magnets.

A significant inventory of NdFeB permanent magnets is now on hand, and increased interest from key supply chain end users and potential strategic partners highlights the near-term potential for further technology rollout.

Kingfisher (LON:KGF) Mining

Kingfisher Mining Ltd (ASX:KFM) has had a busy June quarter advancing exploration at its wholly-owned projects in the Gascoyne and Ashburton Mineral Fields of Western Australia.

During the quarter, the company has made a number of breakthrough high-grade REE discoveries in the Gascoyne region where it holds a target strike length of more than 54 kilometres along the Chalba mineralised corridor and more than 30 kilometres along the Lockier mineralised corridor.

Meanwhile, a parallel strategy assessing the potential for lithium-bearing pegmatites kicked off during the quarter and is now advancing, with mapping and sampling underway.

Furthermore, airborne magnetic radiometric surveys commenced at the Mooloo and North Chalba projects during the Quarter, with the survey now 75% complete and processing and interpretation of the initial areas underway.

Commenting on the company’s activities during the quarter, Kingfisher’s executive director and CEO James Farrell said: “The June Quarter saw the company intensify its focus towards the discovery of REE mineralisation associated with the large-scale feeder pipes of the high-grade vein and dyke mineralisation discovered at MW2, MW7 and MW8.

“We are pleased to confirm the strategy is bearing fruit, with the confirmation of new carbonatite intrusions at the CH8 and CH11 targets, with sample results confirming REE mineralisation at CH8 and that the intrusion is fertile for hosting REE mineralisation.

“On-ground exploration has also commenced at the high-priority LK1 carbonatite target which has all the indications of a large carbonatite system, with a ring of ironstones around the periphery, fenite alteration and highly anomalous geochemistry.

“Access to the target has been established and mapping and sampling are underway. A ground-based gravity survey to refine the large targets is scheduled for August as we seek to advance this exciting opportunity.

“During the quarter, we also embarked on a program of work targeting lithium-bearing pegmatites. The results from initial fertility work from pegmatite samples are eagerly awaited and we will announce details of the ongoing target generation work in the Chalba and Chalba North areas in the coming weeks."

Lindian Resources

The June quarter marked a period of positive growth and innovation for Lindian Resources Ltd (ASX:LIN, OTC:LINIF), with key developments occurring at the Kangankunde Rare Earths Project in Malawi and the Bauxite Assets in Guinea.

Progress on these projects contributes to the company’s strategic positioning in the global market, underlining the commitment to exploring high-grade, non-radioactive rare earths and commercialising bauxite assets.

At Kangankunde, Lindian has continued to deliver outstanding rare earths assay results from its phase one drill program.

At Guinea, Lindian signed a six-year supply agreement for 23 million wet metric tonnes (WMT) of bauxite from its Gaoual Bauxite Project with C&D Logistics.

Towards the end of the quarter, the company completed a $35 million placement and is now well capitalised to fund the construction of its stage one processing plant at Kangankunde.

Lindian executive chairman Asimwe Kabunga said: “Lindian has made excellent progress this quarter across all areas (drilling, assays, stage one processing plant planning and design, engineering, funding, etc.) with the results of the now completed phase one drill program being simply outstanding.

“We look forward to the imminent release of Lindian’s maiden mineral resource estimate for Kangankunde and the assays for the phase two deep drill program which we are confident will demonstrate that Kangankunde is a standout globally significant high-grade non-radioactive rare earths project, having high-levels of NdPr and with the potential for long mine-life.

“At the same time, we continue to make significant progress on commercialising our bauxite assets in Guinea with our strategic objective of having two world-class projects in high-demand commodities leveraged to the rapidly growing electric vehicle industry in operation simultaneously.

“The $35 million placement completed in late July provides the funding required to advance the development of Kangankunde at a rapid rate.

“As a consequence, Lindian is very well placed with sufficient funding to execute our current work programs and immediate strategic objectives.”

Lanthanein Resources

Spearheading REE exploration across its prospective portfolio, Lanthanein Resources Ltd (ASX:LNR) has had a busy June quarter progressing drill programs at its rare earth assets across South and Western Australia.

During the quarter, the company completed an RC drilling program of 9,635 metres targeting large-scale carbonatite targets and high-grade ironstones at the Lyons Rare Earths Project in Western Australia.

Following the completion of the extensive community relations project, the first phase of the roadside air core drilling program at the Murraydium Project kicked off in late March at the Bordertown block of EL671.

At Koolya, Lanthanein revealed the brightness results from the first pass aircore drilling program at Koolya Kaolin Project in Western Australia.

Further analysis will be undertaken to better quantify the presence of Kaolinite and Halloysite using XRD analysis.

Northern Minerals

During the June quarter, Northern Minerals Ltd (ASX:NTU) has taken significant steps towards production at its wholly-owned Browns Range Heavy Rare Earths (HRE) Project in Western Australia.

The company secured a $5.9 million grant from the Australian Government’s Critical Minerals Development Program, to be applied to specific activities to accelerate the Wolverine Project into production.

The definitive feasibility study (DFS) is progressing on schedule with tenders received from the early contractor involvement (ECI) process for the beneficiation plant.

The company also continues to advance discussions with Northern Australian Infrastructure Facility (NAIF) and Export Finance Australia (EFA), regarding additional funding opportunities for Browns Range.

At the field, exploration drilling a seven-hole diamond drilling program at Wolverine Deeps, testing orebody extension at depth delivered strong results demonstrating a continuation of the mineralised structure.

This drilling aims to determine if an inferred mineral resource can be extended down the plunge below the current mineral resource wireframe, thereby potentially extending the life of mine.

Provisional mine designs and schedules for the open pit followed by an underground mine at Wolverine completed.

OD6 Metals

OD6 Metals Ltd (ASX:OD6) has demonstrated promising progress during the June quarter, particularly with the Splinter Rock Project in Western Australia.

During the period, the company delivered ‘bumper’ REE assays from its second phase aircore program with grades averaging in excess of 1,000 ppm TREO.

Also, very high metallurgical recoveries of Magnet Rare Earth Elements (MagREE) using a simple hydrochloric acid leach were achieved in multiple prospect areas at Splinter Rock.

Furthermore, OD6 has kicked off a planned 188-hole phase three drill program across 10,000 metres to test the length of the main prospect and determine the continuity of grade and thickness of the extensions.

The successful drilling phases, substantial metallurgical recoveries, strategic exploration investments, and sound financial health highlight the company's commitment to delivering value.

Parabellum Resources

Parabellum Resources Ltd (ASX:PBL) has delivered a busy June quarter across its NSW copper-gold project in Australia and REE assets in Mongolia.

At the Khotgor REE project, mining, metallurgical and engineering design work is ongoing with a JORC scoping study scheduled for this quarter.

During the quarter, the construction of the concentrator section of the pilot plant in Ulaanbaatar was completed and the first concentrate was produced.

Furthermore, all site environmental monitoring programs were completed and EIS/EIA was prepared.

Parabellum project location.

Read more on Proactive Investors AU