Investing.com - Analysts RBC Capital have initiated an Outperform rating on Westgold Resources Ltd (ASX:WGX) with a price target of 3.3, noting that the company is poised for significant near-term production and earnings growth.

The firm predicts a two-year production increase of 31%, rising from 228koz in FY24 to 299koz in FY26. This growth, leveraged on WGX's existing fixed costs, could potentially boost EBITDA by 115% over two years to A$590m, a 90% increment at spot.

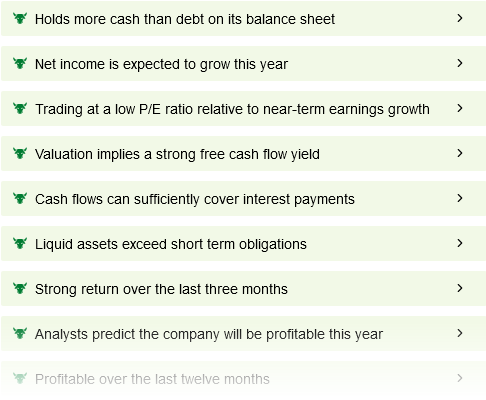

RBC Capital also forecasts an increase in free cash flow (FCF) yields to over 20% as capital becomes increasingly incremental as well as a steady year-on-year growth capex in FY25 (A$120m) before a gradual reduction, with an estimated FCF yield in FY25/26 of 19%/29%.

According to RBC Capital, WGX appears undervalued based on near-term earnings and long-term value. The company trades on FY25e EV/EBITDA of 1.5x, and 0.7x in FY26, well below its historical average of around 3x. Given its profitable maturation, WGX could be expected to rise higher in this group.