The post-COVID-19 geopolitical climate has been the perfect backdrop for the rising demand for rare earth elements (REEs).

On the one hand, there has been huge surge in interest in shoring up domestic production around the world, to de-risk supply of these critical minerals from China, which currently dominates production and downstream processing.

On the other, there is an ever-growing demand for these 17 silvery white minerals, which are at the forefront of the green technology revolution, starring as components in everything from transport-grade magnets, to computing, energy and defence applications.

China’s stranglehold on the industry, with the US a distant second, sets up a commodities race of sorts, and indeed REEs are often spoken of by western governments as having a central role in bolstering economic self-sufficiency – the most obvious example of this is the Biden Administration’s emphasis on securing critical minerals for domestic battery manufacture, through its Inflation Reduction Act.

Appetite for REEs not abating

The global rare-earth metals market size was estimated at US$4,952.36 million in 2020 and, at a compound annual growth rate (CAGR) of 13.32%, is expected to reach US$10,487.72 million by 2026.

REEs are expected to be a primary focus for the resource sector well into the next decade as the global focus remains on decarbonisation and supply de-risking.

The appetite for prized magnet rare earths such as dysprosium, neodymium, praseodymium and terbium is only expected to grow. In particular, neodymium and praseodymium are sought after for their role as components in EVs and wind turbines.

By contrast, experts believe there may be an oversupply of lanthanum and cerium – which are key to energy catalysts for emissions reductions and oil refining – in coming years.

The introduction of the Inflation Reduction Act in the US has prompted a ramping up of domestic downstream activities such as alloy and magnet making. We’re seeing similar trends in Germany with plans to build a magnet plant there, and other countries are weighing the opportunities for in-situ processing and manufacturing.

All this creates a diversified supplier landscape, with China still a dominant player. The question is how this delicate balance might be disrupted by politics, trade and conflict on the horizon.

REE small caps busy in the last quarter

Australian REE exploration is healthy, with several ASX-listers making progress on flagship plays in the March quarter. Here is a cross-section of what they achieved.

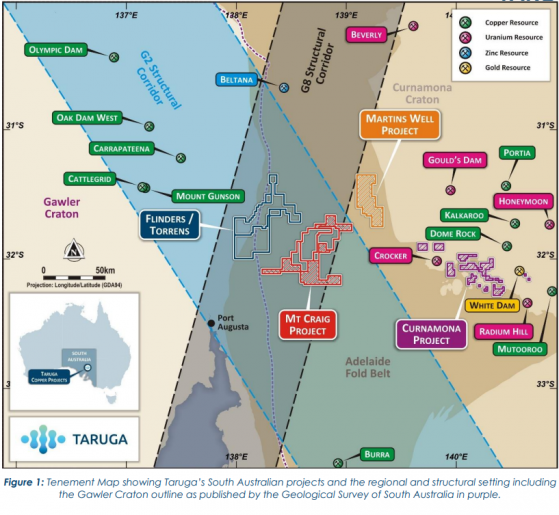

Taruga Minerals

Taruga Minerals Ltd (ASX:TAR) ended the quarter with zero debt and $3 million in the bank, despite drilling activities focused on REE and copper exploration across its South Australian assets.

Drilling at the Mt Craig Project in South Australia uncovered high-grade, clay hosted REEs from surface, with many holes ending in mineralisation, strike extended to 4.3 kilometres at Hydrothermal Hill, and large zones still to be tested by the drills.

Metallurgical test results last quarter revealed extractions of up to 70% magnet rare earth oxides (MREO), 60% heavy rare earth oxides (HREO) and 59% total rare earth oxides (TREO) in initial results. These were achieved with a sulphuric acid leach (50g/L @ 50 Celsius), with the best extractions coming from the well-mapped Yednalue Formation. Optimisation testwork will continue with the focus on refining the flowsheet to align with commercially viable reagent and processing costs.

The company also continued to engage with the SA State Government on heritage issues regarding the Flinders Project.

Parabellum Resources

During the quarter, results came in for a 2022 drilling program Parabellum Resources Ltd (ASX:PBL) conducted at the Khotgor REE Project in Mongolia. These contributed to the delivery of the company’s mineral resource estimate (MRE) for the Mongolian play, delivered in the quarter.

Still at the project, mining, metallurgical and engineering design work continues ahead of a scoping study, which is scheduled for the third quarter of this year.

Construction of the concentrator section of the Pilot Plant in Ulaanbaatar continues apace – it’s now substantially completed, with commissioning set for the second quarter of 2023.

In non-REE news, the company kicked off a reverse circulation (RC) drill program at its Lunns Dam and Recovery copper-gold projects in NSW. Two planned holes are yet to be drilled at the Recovery Project, with 600 samples sent to the lab so far.

"As we progress through the year, we are pleased to see the exceptional results achieved by our Khotgor REE Project team,” non-executive chairman Mark Hohnen said.

“Their hard work and dedication have resulted in a successful infill drilling program, updated JORC 2012 resource, and the construction of a new pilot plant which is substantially completed. Meanwhile, our copper gold projects in NSW continue to move forward with RC drilling underway and 600 samples currently being assayed."

On the cash front, the company had $5.59 million in the bank at quarter’s end.

OD6 Metals

OD6 Metals Ltd (ASX:OD6) finished the quarter confident that its “highly focused exploration spend” of A$883,000 would continue to deliver impressive results.

A maiden aircore regional reconnaissance drilling program at Grass Patch identified high-grade clay hosted rare earths in multiple locations, with the company fielding grades of up to 3,340 parts per million (ppm) TREO. Importantly, there were also “exceptionally” high MREOs encountered too – up to 38.5% of TREO grade.

The first pass reconnaissance drill program highlighted strong potential upside for further targeted drilling at the Belgian, Circle Valley and Scaddan prospects.

Also in the quarter, a second phase of aircore drilling at Splinter Rock delivered better-than-expected assay results, with average grades in excess of 1,000 ppm TREO and extensive clay thickness of between 20 and 80 metres.

Hydrochloric acid leach technology achieved very high metallurgical recoveries of magnet REEs during test work at Splinter Rock, the Centre prospect and the Scrum and Flanker prospects, providing confidence for the company to proceed with further optimisation test work.

Back at the office, the company rolled out foundational sustainability and ESG initiatives at the end of the quarter, rounding out March with a cash balance of $4.723 million.

Northern Minerals

Central to the Northern Minerals Ltd (ASX:NTU)’s concerns during the quarter were the continuing work programs that are all trained on a final investment decision (FID) for the Browns Range Project.

The ultimate goal is to design, construct and commission the proposed commercial-scale mining and beneficiation facility at Browns Range to produce a rare earth oxide concentrate rich in dysprosium and terbium to sell to Iluka Resources Limited pursuant to a supply contract executed in October 2022.

In the March quarter, Northern Minerals Ltd (ASX:NTU) reported that its definitive feasibility study (DFS) continued to progress well, with early contractor involvement (ECI) work on the Browns Range Beneficiation Plant's engineering and design contracted and well advanced.

The company has concluded the geotechnical drilling necessary to complete the DFS and nutted out a mining strategy for an open pit followed by an underground mine at Wolverine. Non-process infrastructure design and studies have advanced in several areas.

Northern Minerals is also drilling at Wolverine Deeps to test orebody extension, with initial results indicating a continuation of the mineralised structure.

Lanthanein Resources

It was a busy quarter for Lanthanein Resources Ltd (ASX:LNR), with a flurry of activity at its Lyons Rare Earth Project, including heritage and flora surveys, the establishment of a field camp for exploration programs and site works for drill access.

Post-quarter, the company has launched a drill campaign at Lyons targeting high-grade mineralisation found at the outcropping ironstones and additional interpreted carbonatite intrusives and ironstones undercover. New ironstones have been discovered during recent sampling of satellite targets.

Over at the Murraydium Rare Earths Project in South Australia, a drill campaign of up to 307 holes kicked off.

In the March quarter, Lanthanein established its ESG baseline in alignment with the World Economic Forum’s Stakeholder Capitalism Metrics. The company says it will use this baseline to continue to progress our ESG journey, improve standards, develop metrics and manage potential ESG risks and opportunities – its ESG Baseline report is now up on Lanthanein’s website.

On the capital front, Lanthanein announced it had received firm commitments from sophisticated investors to raise $2,520,000 (before costs) via a placement of 140 million shares at an issue price of $0.018 per share. The funds raised will be used in the main to fund drill programs planned at the company’s Gascoyne REE Project and the Murraydium Ionic Clay REE Project.

Lindian Resources

During the quarter Lindian Resources Ltd (ASX:LIN) continued to deliver outstanding rare earths assay results from its phase one drill program at the Kangankunde Rare Earths Project in Malawi.

Assays were received and published for total of 44 holes, which all show high-grade REE mineralisation, high levels of the rare earth critical metal elements neodymium and praseodymium (NdPr) that average +20%, and extremely low levels of thorium and uranium, which means the mineralisation is non-radioactive.

Almost all holes are mineralised from surface to end-of-hole and terminate in mineralisation, with grades of up to 13.9% TREO.

Some of the best results include:

- 184 metres @ 3.55% TREO from 4 metres to end-of-hole (EOH);

- 160 metres @ 3.04% TREO from surface to EOH;

- 150 metres @ 3.02% TREO from surface to EOH;

- 317 metres @ 2.70% TREO from surface to EOH; and

- 245 metres @ 2.78% TREO from surface to EOH.

Lindian executive chairman Asimwe Kabunga said: “Lindian has made excellent progress this quarter and we continue to be very encouraged with the results of the ongoing drill program and metallurgical work which further support Kangankunde being a globally significant, high-grade non-radioactive rare earths project, having high-levels of NdPr and with the potential for long mine-life, while advancing all operational areas by the executive team.

“The $9 million private placement announced in late March and completed in early April, which was priced at a significant premium to the market at that time, is demonstrative that others see the potential of the Kangankunde Project in a similar light to the board and our executive team.”

American Rare Earths

American Rare Earths Ltd (ASX:ARR, OTCQB:ARRNF) steers what are “potentially two of the largest rare earth deposits within the United States”. In the March quarter the company made progress advancing the development of its flagship project, Halleck Creek, in the mining-friendly jurisdiction of Wyoming.

Halleck Creek is becoming a strategic asset for the US to help onshore supply of rare earths and de-risk supply, which is currently heavily exposed in favour of China.

The company unveiled a 1.43-billion-tonne maiden resource at Halleck Creek, defining 4.73 million tonnes of contained TREO, including 1.05 million tonnes of highly valuable NdPr.

The mineralisation contains a TREO average grade of 3,309 ppm, including NdPr at 22.2%.

The environmentally friendly, low-cost deposit runs from surface to depths of up to 175.5m with consistent grades throughout, making deposit ideal for large-scale, low-cost open pit mining.

The company also had continued success with metallurgical test work at the project, which demonstrated a conventional process can be used to produce a rare earth concentrate at a 90.5% recovery rate.

In the office, the company:

- completed the process of redomiciling from New Zealand to Australia during the quarter;

- appointed Melissa Sanderson as president of North American operations and Mark Terry as interim chief financial officer; and

- is well funded with a March cash position of $13.465 million.

Australian Strategic Materials

In what was a very busy quarter, Australian Strategic Materials Ltd (ASX:ASM) kicked off stage one of the Dubbo Project EPC Definition contract with Hyundai, delivered NdPr metal production consistently in specification at the targeted daily rate, resulting in a total output of 15.1 tonnes, and successfully completed commissioning of the strip alloy caster at the Korean Metals Plant.

The company also progressed development of customer-specific neodymium iron boron (NdFeB) strip alloys as part of ongoing negotiations of potential sales agreements, and broadened Dubbo Project and Korean Metals Plant offtake marketing and strategic partner discussions in Europe, Japan and the USA, while continuing discussions in Korea.

ASM also underwent a formal ESG risk assessment, measuring ASM's exposure to, and management of, material ESG issues across its global entities. The formal assessment was completed in January 2023 and is now available to the public on the Sustainalytics website.

Preliminary work began for the terbium/dysprosium (Tb/Dy) process flowsheet pilot program. Work included procurement of feed materials and initial bench scale testing, in preparation for the pilot plant operation to begin in August. The work is supported by funds awarded under Stream 1 of the NSW government’s Critical Minerals and High-Tech Metals Activation Fund.

ASM was awarded the grant for studies to finalise the process flowsheet for the Dubbo Project's Heavy Rare Earths solvent extraction circuit. This is being developed in collaboration with the Australian Nuclear Science and Technology Organisation (ANSTO).

Ionic Rare Earths

Over at Ionic Rare Earths Ltd (ASX:IXR, OTC:IXRRF), the focus was on the flagship Makuutu Rare Earths Project, where the company moved to 60% ownership during the quarter.

A stage one definitive feasibility study (DFS) was wrapped up, which confirmed the technical and financial viability of an initial 35-year mine life with first mixed rare earth carbonate (MREC) production targeted for the final quarter of 2024.

Some other DFS metrics for stage one included:

- an EBITDA of A$2.29 billion (US$1.60 billion);

- post-tax free cash flow total around A$1.46 billion (US$1.02 billion);

- pre‐tax NPV8 of around A$580 million (US$406 million);

- post‐tax NPV8 of around A$397 million (US$278 million);

- capital expenditure (CAPEX) of US$120.8 million;

- post-tax IRR of around 32.7%; and

- post-tax capital payback of around three years from first MREC production.

The Makuutu stage one plant capacity is 5 million tonnes per annum (tpa) run-of-mine (ROM) throughput, producing a value-added MREC product, including Scandium, via a modular heap desorption processing plant.

The company’s magnet recycling demonstration plant is also progressing apace, towards production of separated and refined magnet rare earth oxides by the end of the second quarter of 2023.

Kingfisher (LON:KGF) Mining

During the quarter Kingfisher Mining Ltd (ASX:KFM) fielded some promising rare earth assays from MW2, with intersections including:

- 5 metres at 2.63% TREO and 0.54% NdPr from 124 metres, including 3 metres at 4.11% TREO and 0.85% NdPr from 124 metres;

- 4 metres at 3.24% TREO and 0.54% NdPr from 46 metres; and

- 3 metres at 2.52% TREO and 0.41% NdPr from 46 metres.

The company says the drilling results confirm the company’s 54-kilometre Chalba corridor as the next significant REE corridor in the rapidly emerging Gascoyne region.

Mapping and rock chip sampling results significantly expanded upon the MW2 and MW7 discoveries.

The 300-metre wide mineralised zone at MW2 which includes multiple lodes has been extended to a strike length of 2.4 kilometres, while new high grade rock chip assays from MW7 extend the strike length of the mineralisation by 500 metres to over 1.5 kilometres, with two new lodes identified at the prospect.

The identification of another high grade REE area at the KF3, 15 kilometres east of the initial Mick Well REE discoveries further expands the company’s REE exploration footprint.

Large-scale airborne radiometrics and magnetics surveys identified numerous potential carbonatite intrusions across the entire length of the 54-kilometre Chalba shear and along 30 kilometres of the Lockier shear.