Ramelius Resources Limited (ASX:RMS) and Musgrave Minerals Ltd (ASX:MGV, OTC:MGVMF) have entered into a Bid Implementation Agreement (BIA), pursuant to which Ramelius will acquire Musgrave by way of a cash and scrip off-market takeover offer.

Located in the richly endowed Murchison province and with a resource of 12.3 million tonnes at 2.3 g/t for 927,000 ounces gold, Musgrave’s Cue Project will provide additional scale through regional consolidation with Ramelius’ Mt Magnet processing facility, located 35 kilometres to the south.

Ramelius, a top 10 Australian gold producer, has the financial capacity, operational experience and exploration expertise to continue the significant work done by Musgrave with a view to expand the existing resource and develop the Cue Project, in order to maximise the value of the project for both sets of shareholders.

$201 million valuation

Under the terms of the offer, Musgrave shareholders will receive 1 Ramelius share for every 4.21 Musgrave shares held and $0.04 cents in cash for every Musgrave share held.

The offer consideration values each Musgrave share at $0.34, based on the 1-day volume weighted average price (VWAP) of Ramelius shares on 30 June 2023 of $1.263, and implies a total undiluted equity value for Musgrave of about $201 million.

The options held by the Musgrave option holders, if not exercised into ordinary shares before the offer closes, are proposed to be acquired via a private treaty with Ramelius where such options will be valued using traditional option valuation methodologies.

Offer premium

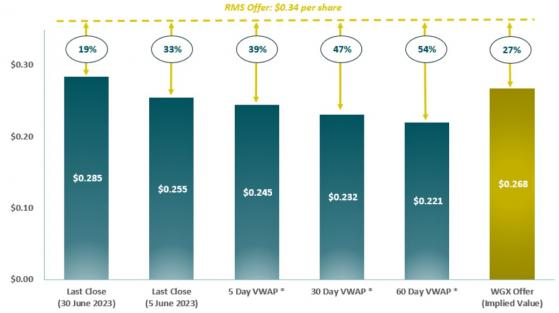

The premiums represented by the offer price against Musgrave’s last close, undisturbed close on 5 June 2023 and various undisturbed VWAPs are shown below, as is the premium to the currently implied offer price made by Westgold Resources Ltd (ASX:WGX) based on Westgold’s closing price of $1.44 per share on 30 June 2023.

Offer premiums for Musgrave shareholders.

Support from Musgrave board and major shareholders

Musgrave’s directors have unanimously recommended that Musgrave shareholders accept the Ramelius offer, in the absence of a superior proposal.

Furthermore, Musgrave directors have entered into binding pre-bid agreements in relation to shares which they own or control, representing ~2.43% of Musgrave shares on issue, whereby they have agreed to accept within 5 days after the offer opens.

Musgrave’s largest shareholder, Westminex Pty Ltd (and associated entities), has also supported the offer by signing prebid agreements representing ~9.70% of Musgrave shares on issue on the same terms as the Musgrave directors.

The total level of pre-bid commitments is ~12.13%.

“We are confident that the Cue Project will be in good hands”

Musgrave managing director Robert Waugh, said: “The Musgrave board of directors is pleased to endorse Ramelius’ cash and scrip offer for the company in the absence of a superior proposal.

“Ramelius is a reputable and well respected Western Australian gold miner with a track record of operational excellence and delivering strong capital returns for shareholders.

“We are confident that the Cue Project will be in good hands should the Offer be successful and in the event that does occur, we would look forward to seeing the project contribute to the ongoing success of Ramelius’ Mt Magnet operations.

“By joining with Ramelius, Musgrave shareholders will have the opportunity to continue to share in the upside at the Cue Project while accessing the benefits that come with being an owner of an established, profitable mining company.

“The cash component of the offer provides additional certainty.”

A high-grade satellite mine for Mt Magnet

Ramelius managing director Mark Zeptner said of the offer: “The Checkers mill at Mt Magnet represents a natural processing option for ore from the Cue Project, including the high-grade Break of Day ore.

“Subject to the Offer being successful, Ramelius is looking forward to continuing drilling across the tenement package to expand the existing resource and ultimately developing the Cue Project into a high-grade satellite mine for the Mt Magnet production centre, to maximise value for all shareholders.

“We also look forward to welcoming Musgrave shareholders as Ramelius shareholders and encourage Musgrave shareholders to accept the Offer as soon as they are able to.”

Read more on Proactive Investors AU