Queensland Pacific Metals Ltd (ASX:QPM) is just weeks away from finalising its Moranbah Project acquisition and bringing an established coal mine waste gas asset into the fold.

The critical battery metals stock, which is working to vertically integrate an energy supply chain to support its cornerstone TECH Project, is in final talks with Moranbah’s vendors to finalise ownership and complete the deal by the end of July.

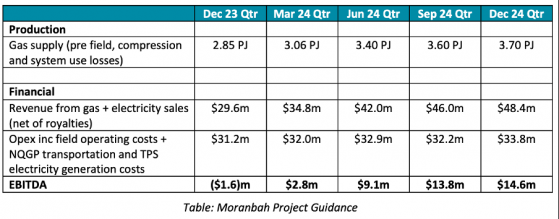

Ahead of the transaction’s close, QPM’s energy arm (QPME for short) has developed gas supply forecasts and operating budgets based on an extensive review of Moranbah’s historical operations and field development plans.

In good news for the project’s new owner, QPME expects the gas asset to generate positive earnings through 2024 based on its production, operating and electricity price assumptions.

Where to from here?

QPME has been working closely with relevant stakeholders to meet all condition precedents and reach financial close on the Moranbah Project acquisition.

Importantly, the company’s energy arm has received official correspondence from the Queensland Government regarding its intention to approve the transfer of the Moranbah Project Petroleum Licences to QPME.

In other project news, QPME has tapped asset management expert Ben Visser to join the team as general manager of development and operations.

Visser has worked across the oil and gas, mining and petrochemical industries, and he’s been directly responsible for developing and managing large coal seam gas and conventional production operations in Queensland and the Northern Territory.

The Moranbah Project’s resources and reserves.

Meanwhile, experienced gas field operator Upstream Production Solutions has been contracted to operate the Moranbah Project and is well advanced in achieving operational readiness, which includes transferring a sizeable portion of the experienced Moranbah Project team.

At financial close, QPME will own the Moranbah Project assets, receive all project revenues and have financial responsibility for operating and capital costs.

Arrow Energy will continue to operate the project for a short period of time to facilitate a smooth transfer of operatorship to UPS.

Read more on Proactive Investors AU