QMines Ltd (ASX:QML) has delivered a 104% increase in resource tonnage to 11.86 million tonnes at 1.22% copper equivalent at the flagship Mt Chalmers Project in Queensland with 84% in the measured and indicated categories.

The third mineral resource estimate (MRE) update since acquiring the project in January last year has delivered a 44% increase in contained metal to 144,700 tonnes at 1.22% copper equivalent and a 119% increase in measured & indicated tonnes to 10 million tonnes.

This update represents a 160% increase in metres drilled in 2022 compared with 2021 for a total of 15,323 metres.

Significantly, the company has also completed a maiden resource estimate for Woods Shaft deposit, 700 metres to the southwest of the Mt Chalmers main deposit, which represents the fourth MRE.

Recent drilling at Woods Shaft has provided the company sufficient confidence in historical drilling results to calculate a maiden inferred resource of 540,000 tonnes at 0.5% copper and 0.95 g/t gold for 2,700 tonnes of copper and 16,440 ounces of gold.

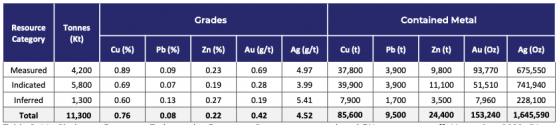

The Mt Chalmers resource, excluding Woods Shaft, now stands at 11.3 million tonnes at 0.76% copper, 0.42 g/t gold, 4.52 g/t silver, 0.22% zinc and 0.08% lead for 85,600 tonnes of copper, 153,240 ounces of gold, 1.6 million ounces of silver, 24,400 tonnes of zinc and 9,600 tonnes of lead.

Measured and indicated categories for the Mt Chalmers resource now account for 88% of the total.

The company is already working on delivering the fifth update in the first half of next year.

Mt Chalmers MRE by resource category reported at 0.3% copper cut-off, November 2022.

Quality project

QMines’ executive chairman Andrew Sparke said: “We are extremely pleased to have delivered our third and fourth resources at the Mt Chalmers project in just 18 months since listing.

“This achievement demonstrates the quality of the Mt Chalmers project, the motivation of our team and the project's development potential.

"With drilling continuing and our team already working towards our fifth resource update, we look forward to continuing to deliver shareholder value as we seek to supply a green copper product that supports the global energy transition.”

Extending mineralisation

Drilling at Woods Shaft has extended mineralisation to more than 250 metres in strike and up to 40 metres wide. Mineralisation is from surface to a depth of 90 metres in places and contains gold and base metal mineralisation.

The Woods Shaft deposit is a gold/copper dominant volcanic-hosted massive sulphide (VHMS) deposit, similar to the Mt Chalmers main lode and is dominated by a sulphide stringer zone.

QMines’ drilling here has delivered several exceptional broad intersections of copper grading up to 8.26% copper equivalent and 6.21% copper equivalent.

Woods Shaft MRE at different cut-offs, November 2022.

Growing resource

QMines owns 100% of four advanced projects covering a total area of 1,096 square kilometres. Its flagship Mt Chalmers project is 17 kilometres northeast of Rockhampton.

The company’s objective is to grow the project’s resource base, consolidate assets in the region and assess commercialisation options, and has commenced an aggressive exploration program of more than 30,000 metres.

Read more on Proactive Investors AU