A pre-feasibility study (PFS) for the flagship Mt Chalmers Project of QMines Ltd (ASX:QML) in Queensland demonstrates a technically and financially robust project that supports a viable copper and gold mine.

The PFS assesses the development of a standalone copper and gold mining and processing operation at Mt Chalmers, which is 17 kilometres northeast of Rockhampton in central Queensland, utilising a three-stage open pit operation and processing that material onsite.

Development of the project in three stages has several obvious benefits including the rapid payback of capital, just 1.84 years, and the generation of immediate financial returns for its owners.

QMines describes the Mt Chalmers project as truly unique given it's a shallow, high-grade, open pit project with high recoveries, located close to the coast and infrastructure. It is these qualities that drive the strong financial returns of the project.

The proposed mining and processing operation is a low-cost, high-margin and long-life project with immediate opportunities to grow scale and improve upon already robust financial returns. The project has been optimised to mine higher grade material early in the mine life

High margin

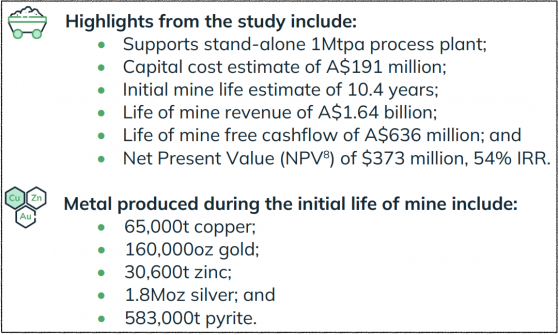

The project delivers strong margins, even at current spot prices. The pre-tax net present value (NPV) of the project is $373.4 million (at an 8% discount rate) and has an internal rate of return (IRR) of an impressive 54%.

This demonstrates the cost benefits of shallow, open pit mining. The average life of mine C1 costs are just US$2.14/lb providing strong margins at the current copper spot price of US$4.50 per pound and as forecast throughout the project life.

Low cost

The PFS estimated the project capex at just A$191.9 million with an opex estimate of just A$32.86 per tonne. The financial model provides C1 costs of just US$2.14/lb copper equivalent over the life of mine (LOM).

Mt Chamers project appears readily financeable with a NPV to capex ratio of around 2:1.

Long life

The proposed Mt Chalmers mining operation is supported by a maiden ore reserve of 9.5 million tonnes (proved and probable) and 837,011 tonnes of potential mining material (inferred).

This demonstrates an initial mine life of 10.4 years. Incorporating additional known deposits would provide immediate expansion opportunities.

“Significant milestone”

The PFS concluded that the Mt Chalmers project is technically achievable and commercially viable. The proposed development of Mt Chalmers presents an opportunity for QMines to establish and grow a mining and processing business within the critical metals sector with an attractive risk-return profile and clear potential to further enhance project returns through the expansion of production rates and extensions to the project life.

QMines executive chairman Andrew Sparke said, “The completion of the pre-feasibility study represents a significant milestone for the business and our shareholders as we continue to demonstrate Mt Chalmers is a project with scale and potential for development.

"The company has demonstrated that Mt Chalmers can be commercialised using industry-standard treatment processes and techniques. With improving base metals prices associated with supply constraints, Mt Chalmers represents a low cost, high margin and long-life project with immediate upside from three satellite deposits and a large exploration package.”

The company notes that the PFS results are reported from modelling of mining and processing of only the Mt Chalmers resource at the Mt Chalmers project. Resources at Develin Creek — Sulphide City and Scorpion — and Woods Shaft have not been considered at this stage and are considered upside potential.

Read more on Proactive Investors AU