After rallying 15% in just two months, the copper price is at 15-month highs and analysts are betting on a bright outlook for the metal. They point to supply concerns, combined with improved demand prospects, making a copper shortage “virtually inevitable”.

Analysts have long been anticipating a profound copper supply deficit after years of underinvestment in the sector, project shutdowns, few significant new discoveries and the energy transition’s dependency on copper. Yet the deficit has been slower to materialise than expected.

In recent years, high interest rates and high inflation across major economies have kept a lid on growth along with the demand for copper. Against this backdrop, the price of copper remained relatively stable.

However, with inflation pulling back in 2024, and US interest rate cuts anticipated, the copper price looks set to continue the strength it has exhibited in the past two months. This strength comes as mine disruptions threatened refined-copper production at Chinese smelters, which account for more than half the world’s supply.

Meanwhile, investors are betting on stronger consumption as manufacturing picks up and copper is increasingly in demand for use in solar panels, wind turbines, electric vehicles and power cables. As the world moves towards eliminating carbon emissions, copper consumption needed to support the energy transition is expected to surge over the coming years.

Perhaps surprising, artificial intelligence and data centres are set to be linked to a significant lift in copper demand. Switzerland-based commodity trader Trafigura suggests that AI and the data centres needed to support it could demand up to one million metric tons of copper by 2030, exacerbating supply deficits towards the end of the decade.

That one million tonnes is “on top of what we have as four to five million tonne deficit gap by 2030 anyway. That's not something that anyone has actually factored into a lot of these supply and demand balances," Trafigura chief economist Saad Rahim said at the recent Financial Times Global Commodities Summit.

According to Goldman Sachs’ Copper is the New Oil – Green Metals report, it is estimated that green copper demand will grow at an average annual growth rate of 20% year on year in the 2020s.

The opportunity: QMines

This situation presents an attractive opportunity to aspiring copper producers — particularly those that can deliver copper producers with low carbon emissions for the green energy transition.

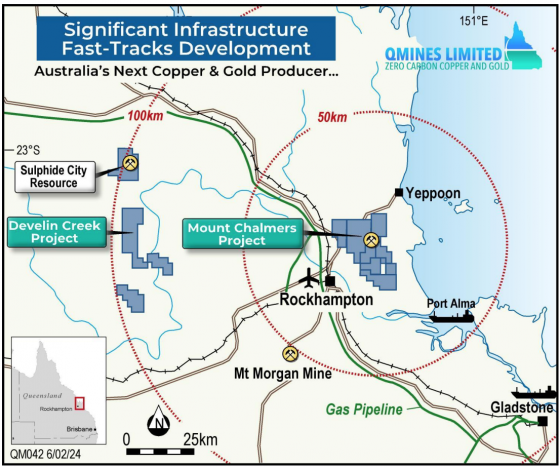

Seeking to become Australia’s first zero-carbon copper and gold producer, QMines Ltd (ASX:QML) is exploring and developing two advanced projects in Queensland — its flagship Mt. Chalmers Copper and Gold Project and the high-grade Develin Creek Copper Zinc Project, which it acquired last August.

The two projects, near Rockhampton in South-East Queensland, lie about 90 kilometres apart and, together, they cover an area of around 604 kilometres.

QMines is one of only three ASX listed resources companies that are certified carbon neutral under the Climate Active initiative. It is generating a social licence to operate, using renewable energy, renewable fuel and rainwater, while procuring goods and services locally.

Since listing in May 2021, QMines has rapidly grown its resource base at the Mt Chalmers project. The resource has been updated four times with the most recent update in November 2022 to total resources of 11.86 million tonnes at 1.22% copper equivalent for 144,700 tonnes of contained copper equivalent metal.

Upon its acquisition of Develin Creek, the company released its fifth mineral resource estimate for a new combined total of 15.1 million tonnes at 1.3% copper equivalent for 195,800 tonnes of contained metal.

Pre-feasibility study underway

QML is currently in the final stages of preparing its important pre-feasibility study (PFS) that will assess the viability and define the economics of its Mt Chalmers and Develin Creek copper projects as a stand-alone mining operation.

The company commenced the Mt Chalmers PFS in November 2023 and work undertaken by the company and its independent consultants includes geotechnical diamond drilling, metallurgical test work, design of the treatment plant and flow sheets, PFS level design of the tailings storage facility and updated open pit optimisations estimates.

The PFS is due to be finalised and released in the fourth quarter of 2024.

Additionally, QML has massive growth potential and “district scale’ opportunity. With six known deposits and 34 electromagnetic anomalies discovered in a recent VTEM survey, the Mt Chalmers project provides shareholders with significant leverage to exploration success.

Read more on Proactive Investors AU