Qantas Airways (ASX:QAN) has seen a notable decline in its brand strength, now ranking 41st among Australian brands, following legal challenges last year regarding ticket sales for cancelled flights and controversial flight credit policies, according to a report in the Australian Financial Review.

In contrast, Woolworths Group Ltd has maintained its position as Australia's leading brand despite potential government regulation on supermarket pricing policies.

Brand Finance Australia managing director Mark Crowe highlighted Qantas' brand deterioration as a warning to investors.

The airline's troubled year included the early exit of chief executive officer Alan Joyce, legal confrontations and rising customer complaints, culminating in a Brand Finance score of 71.35, behind companies like Myer and Origin Energy.

Huge red flag

“A 10-point drop is a red flag to say something very significant has happened here,” Crowe said.

“Last year, when Qantas declined by four points, they saw decreases across value for money, recommendation, reputation and loyalty.

“But this year, these decreases have become more profound. And they come at a time when, if you looked at our global 500, many airlines are increasing in brand strength and brand value.”

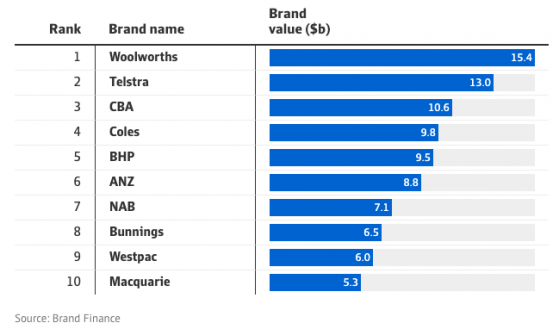

Meanwhile, Woolworths remains the biggest brand in Australia, valued at $15.4 billion, with Bunnings leading in brand strength, scoring 88.23.

This was followed by IAG-owned NRMA with 87.04, which overtook Woolworths, now 84.68.

Telstra ranked fourth, with 83.37, JB Hi-Fi at fifth with 82.7 and Seek at sixth with 82.27.

By brand value, the top four Australian brands lost almost $3 billion over the past year, as cost-of-living pressures punished retailers but, conversely, rewarded insurers.

Reputation is everything

Brand Finance's annual survey, revealing the top brands in Australia, shows the fluctuating fortunes of various sectors, with the insurance sector seeing significant gains, while retail brands faced modest growth.

Its Australia 100 and Global 500 brand valuations and rankings for 2024 measured $430 billion in Australian brand equity and was released at the World Economic Forum in Davos, Switzerland.

“We’re seeing reductions in scores around reputation and also in terms of value for money and recommendations,” Crowe said.

“In difficult economic conditions where people are more price sensitive, clearly it’s an environment where negative perceptions will come to the fore.”

Atlassian in top 100

Atlassian appeared in the top 100 for the first time, with a brand value of $4.8 billion – the 12th largest.

“They haven’t been previously assessed – they’re a brand to watch,” Crowe said.

“If they continue to strengthen the brand, invest in the brand, there’s no doubt they are capable of becoming a top 10 brand in Australia.”

Read more on Proactive Investors AU