Provaris Energy Ltd (ASX:PV1, OTC:GBBLF) has reaffirmed the cost-effective and energy-efficient nature of its compressed hydrogen technology and supply chain ambitions with the results of a concept design study.

The company says the findings “reaffirmed the low energy use and low capital of Provaris’ compressed hydrogen supply chain for regional marine transport of hydrogen in gaseous form”.

This study assessed a 540-megawatt (MW) capacity reservation export site, producing 10 tonnes of hydrogen per hour (87,000 tonnes per year) with an intra-European shipping distance of 1,000 nautical miles using the H2Neo carrier to deliver gaseous hydrogen to the customer at 70 barg (a metric unit of gauge pressure).

Advantages over ammonia conversion

“The concept design study reconfirmed the superior energy efficiency and low capital cost associated with compression for marine transportation of hydrogen,” Provaris Energy product development director Garry Triglavcanin said.

“It is pleasing to receive detailed costings and equipment selection from the Compressor OEM, supporting our development case in Europe.

“This study has increased our confidence and understanding that many regional-European sites with a material level of renewable power reservation can significantly benefit from compression when compared to the alternative of converting hydrogen into ammonia for marine transport.

“The benefits of compression include delivering more hydrogen in volume, using less capex, and boosting the financial returns to the producer whilst maintaining a highly competitive delivered cost to the customer.”

PV1’s study outlined low energy requirements of about 1.5 kilowatt-hours (kWh) per kilogram of hydrogen for storage and loading compression and 0.2 kWh for unloading.

Total compression energy consumption represented only 2.8% (15MW) of total site power, with the remaining 97.2% (525MW) available for hydrogen production via electrolysis.

PV1’s compression technology outperformed ammonia conversion by up to five times, according to the study, as ammonia would require 7.5 kWh per kilogram of hydrogen or 65MW, leaving 470MW for electrolysis.

Greater hydrogen delivery levels

Apart from being overall a more energy-efficient process, hydrogen compression also allowed more net hydrogen to be delivered over time when compared to ammonia conversion.

With little to no hydrogen loss, PV1’s study revealed its hydrogen compression methods result in significantly higher volumes of hydrogen being delivered to the end customer (and thus generating profit) each year.

In terms of megawatts used, compression allows 87,600 MW of 90,000 available to be converted directly into saleable volumes of hydrogen while the ammonia cracking process allows for just 58,500 MW worth of hydrogen to be delivered to consumers due to higher energy inputs, representing an almost 40% difference in efficiency.

As a result, compression-based hydrogen shipping is notably cheaper, requiring about €6 per kilogram compared to €7.40 for ammonia, reducing the cost of delivering hydrogen by about 20%.

EU hungry for cheap hydrogen

Provaris believes its technology is exceptionally well placed in the current European hydrogen market.

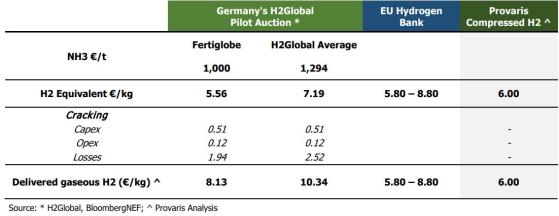

This year the H2Global and EU Hydrogen Bank auctions allocated €1.1 billion in funding to green ammonia and hydrogen projects, with winning project bids representing an average levelized cost of between €5.8 per kilogram and €8.8 per kilogram of hydrogen.

The EU Hydrogen bank intends to allocate a further €1.2 billion later this year, while the H2Global pilot auction awarded €394 million to Fertiglobe as the sole recipient.

Below is a comparison between Fertiglobe’s project, an aggregate average of EU Hydrogen Bank award recipient projects, and PV1’s project economics:

With Germany projected to require 1.5 to 3 million tonnes of hydrogen per year by 2030, PV1 is keen to take advantage of its strategic partnerships and cost-effective technology to secure a first-mover advantage in this rapidly emerging energy sector.

Read more on Proactive Investors AU