Investing.com - In the stock market and other sectors, artificial intelligence (AI) has emerged as a potent tool, capable of analyzing vast data sets, uncovering patterns, and predicting trends with striking accuracy.

Despite these advancements, the nuanced world of investment still requires the irreplaceable touch of human insight. This blend of AI’s computational prowess and human expertise is at the forefront of transforming investment strategies, striking a balance between technological efficiency and the discerning judgment of seasoned professionals.

With this in mind, InvestingPro's ProPicks strategies have been developed. ProPicks harness this synergy, leveraging AI to sift through complex financial data, while also employing human analysis to contextualize and effectively apply these findings.

This innovative approach paves the way for investment decisions that are not only data-driven but also tempered by human wisdom, ensuring a more holistic and informed approach to stock investment.

Take advantage of ProPicks strategies - Receive an additional 10% off on the Pro+ 2-year subscription using the promo code "INVPRODEAL".

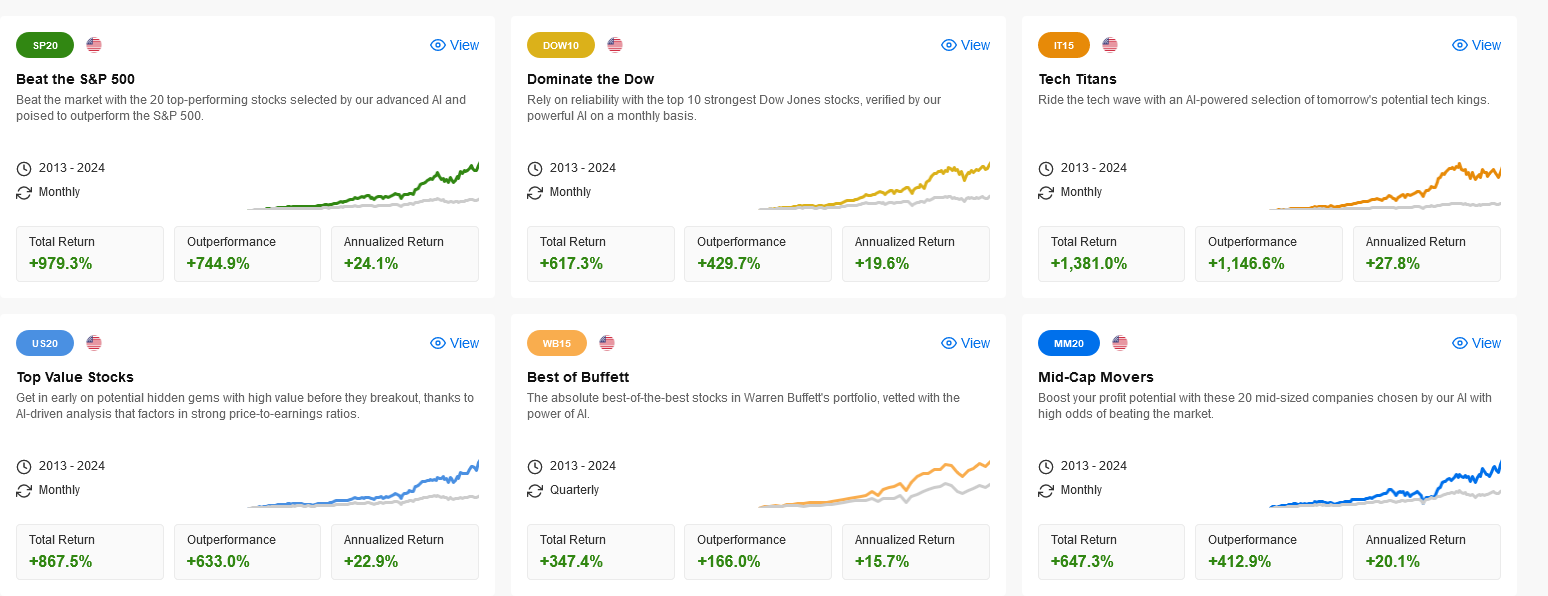

Leveraging these tools, we have created six thematic portfolios. These stock picks are predicted to outperform traditional market benchmark indices, are reassessed monthly, and have shown average annual returns of 15 to 25% over the last ten years:

- Outperform the S&P 500: The top 20 stocks of the S&P 500

- Dominate the Dow: The 10 strongest stocks of the Dow

- Tech Titans: High-performance technology stocks

- Best Value Stocks: For investors prioritizing security

- The Best of Buffett: The Oracle (NYSE:ORCL) ORCL) of Omaha's top investment choices

- Mid-Cap Champions: 20 medium-sized stocks selected for their high upward potential

At the heart of the ProPicks initiative lies a sophisticated AI model. This model serves as an analytical brain, mining more than two decades of exhaustive financial data spanning multiple sectors. It meticulously examines over 50 financial indicators from thousands of companies, thus creating a rich tapestry of data. This vast pool of information not only enhances the accuracy of the AI's assessments but also plays a crucial role in neutralizing any inherent analytical bias.

The AI undertakes a comprehensive analysis, correlating numerous financial parameters with stock performance over the years. This complex process results in a systematic categorization of stocks: underperforming, neutral, or outperforming. This categorization is fundamental in identifying stocks that historically have shown they can eclipse market benchmark indices.

Following the AI's stock assessment, ProPicks introduces a variety of selection filters, including factors such as trading patterns, industrial sectors, geographical regions, stock index inclusions, and market dynamics. The most promising stocks are then assembled into distinct ProPicks strategies, each reflecting different investment interests and profiles, from leading S&P 500 stocks to top-tier tech stocks.

During this stage, stocks irrelevant to the average investor, like penny stocks, are eliminated. Each strategy is crafted to ensure its robustness, relevance, and practical application in real investment scenarios.

Furthermore, an integral component of the ProPicks process is the extensive backtesting of each strategy against historical data. This step is crucial in assessing a strategy's historical performance and providing insight into its potential effectiveness in the future. It's a rigorous test that ensures only strategies that withstand stringent evaluation are chosen to be featured on Investing.com.

ProPicks strategies are developed using a meticulous and comprehensive methodology:

- Data Processing: The process begins with the collection and preprocessing of over 25 years of financial data to ensure its completeness and accuracy.

- AI Model Training: Thanks to Google (NASDAQ:GOOGL)'s Vertex (NASDAQ:VRTX) AI platform, the entire data set is preprocessed, and the AI model is trained. The model is dynamic and continuously enriched with new data to refine its predictions.

- Data Analysis and Strategy Development: The AI model's predictions form the basis of the ProPicks strategies, which are periodically updated to reflect the AI's latest findings.

- Performance Evaluation through Backtesting: Each strategy undergoes rigorous backtesting to evaluate its historical effectiveness.

In conclusion: A New Frontier in Stock Investment

InvestingPro's ProPicks thus mark a new milestone in formulating investment strategies. These strategies, at the intersection of AI innovation and financial expertise, offer investors a nuanced, data-centric approach to stock selection. For those navigating the complex terrains of the stock market, ProPicks represents a new technological path toward enlightened investment decisions.

Now, you can benefit from this at an unbeatable price. We're offering our loyal readers an extra 10% off on the Pro+ 2-year subscription using the code "INVPRODEAL".