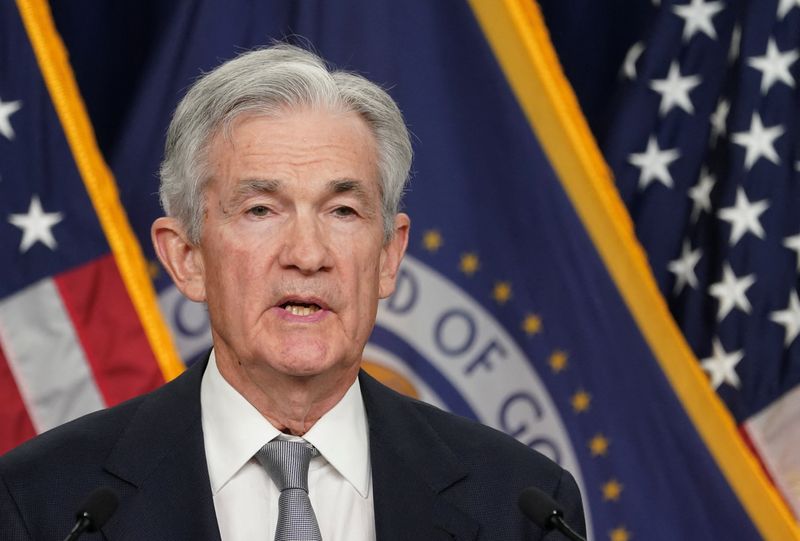

Federal Reserve Chair Jerome Powell is unlikely to signal a 50 basis point (bp) rate cut at the upcoming Jackson Hole symposium next week, Piper Sandler strategists said in a Thursday note.

The investment bank notes that Powell could simply update the recent FOMC statement, adding a phrase such as “the Committee is gaining greater confidence” that the inflation rate is subsiding to the Fed’s target of 2%.

“A bolder tip would be something like “it may be appropriate to reduce the target at an upcoming meeting”,” Piper Sandler remarked.

The firm's strategists suggest that, with additional data still to come before September, Powell may be hesitant to get ahead of the FOMC.

They emphasize that none of these potential scenarios are particularly significant, as the median and mode of the June dot plots already suggest 1 and 2 rate cuts before year-end, respectively, with only three meetings remaining.

“What we don’t expect are hints of a faster pace down to neutral,” strategists wrote. “So, no, Powell won’t tee up a 50-bp move, say.” A comment such as “That’s not something we’re thinking about right now” is still the more likely case, they added.

In terms of market impact, while some Jackson Hole speeches have been significant market events, such instances are rare, according to Piper Sandler.

For example, out of 22 speeches since 2000, only two led to significant changes in the 10-year UST yield, and just twice did the S&P 500 experience outsized returns on Jackson Hole days.

Overall, large market reactions after this event “are the exception, not the rule.”

“All in all, J-Hole just hasn’t reliably prompted strong market reactions, whatever the anticipation. We surmise that Fed Chairs usually pass on unveiling any substantial policy shifts. Put another way, Powell is in no way obliged to drop a doozy next week.”