Piedmont Lithium (NASDAQ:PLL) Inc (ASX:PLL, NASDAQ:PLL, XETRA:)’s partner Atlantic Lithium Ltd has revealed high-grade lithium drilling results from the Ewoyaa Lithium Project in Ghana, West Africa.

Further assay results have been received for 5,444 metres of infill and exploration reverse circulation (RC) drilling completed at Ewoyaa as part of the broader 18,500-metre 2023 planned drilling program.

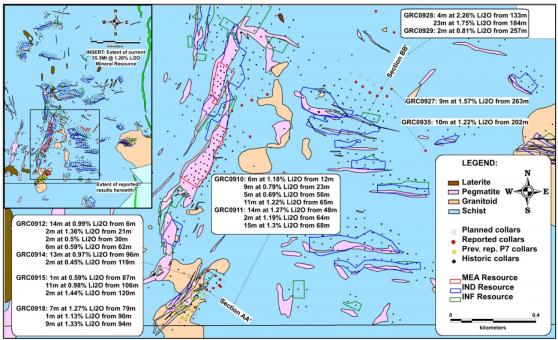

Highlights results at a 0.4% Li2O (lithium oxide) cut-off and a maximum 4 metres of internal dilution include:

- GRC0928: 23m (metres) at 1.75% Li2O from 184m;

- GRC0911: 15m at 1.3% Li2O from 68m;

- GRC0911: 14m at 1.27% Li2O from 48m; and

- GRC0927: 9m at 1.57% Li2O from 263m.

Location of reported assay results with highlight drill intersections.

Importantly, the newly reported assay results infill mineralisation at the Ewoyaa South-2 deposit, part of the 35.3 million tonnes at 1.25% Li2O Ewoyaa resource and extend mineralisation to depth at the Ewoyaa North-East deposit, outside of the current resource.

Piedmont is in the process of earning a 50% ownership interest in Ewoyaa.

Based on the recent completion of the DFS and Piedmont’s election to proceed into project development, the company is expected to earn the first 22.5% ownership interest in Ewoyaa.

Atlantic is progressing through the mine permitting process, targeting construction at Ewoyaa to start in the second half of 2024, with first production expected in 2025.

“Further drilling for resource growth”

Atlantic executive chairman Neil Herbert said: “We are pleased to report ongoing drilling assay results across the Ewoyaa Lithium Project, which have returned high-grade infill and extension intersections.

“These include some significant apparent widths and grades from relatively shallow depths.

“Results are from the Ewoyaa South-2 deposit, where we are infill drilling to convert Inferred to Indicated Resources to provide optionality for future mine scheduling, and from the Ewoyaa North-East deposit, where mineralisation has been confirmed outside of the current Resource envelope and at depth.

“A total of 18,500m of infill, extensional and exploration RC drilling has been planned for 2023. These programmes are intended to grow and improve the confidence of the Ewoyaa Resource, in turn, improving the economics of the Project.

“Following the completion of the passive seismic survey over the central portion of the Ewoyaa Resource area, we have decided to demobilise the equipment, rather than extending the survey. Due to various limitations, not all known pegmatites were identified by the survey. Whilst a 10m mineralised pegmatite was intersected in drilling from one of the targets, this was the extension of a known pegmatite where mineralisation remains open at depth.

“The survey has enhanced our knowledge of the Ewoyaa deposits and provided valuable learnings for potential future use of the technology across the company’s portfolio or new opportunities at a later date. However, at this stage, we see greater value in deploying capital towards the systematic drilling programmes that have been proven to deliver significant value to the company to date. This will comprise further drilling for resource growth within the immediate project area, whilst continuing to grow the exploration pipeline within the broader portfolio using soil sampling, geophysics and auger drilling ahead of RC drill testing.

“We look forward to updating shareholders on our ongoing progress, including as remaining assay results become available.”

Read more on Proactive Investors AU