Perseus Mining Ltd (ASX:PRU, TSX:PRU, OTC:PMNXF) has had a bumper year with higher gold production and prices leading to record profit for the 2023 financial year and enabling the company to pay a bonus dividend to shareholders.

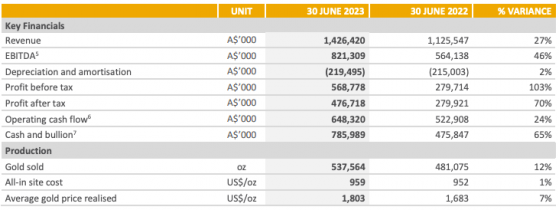

The African-focused gold producer reported a net profit before tax of A$568.8 million for the year ended June 30, 2023, a 103% increase from the previous year on the back of a 27% increase in revenue to A$1.4 billion.

“Record financial results for FY23 reflect our continued strong operating performance at all levels of our business,” Perseus managing director and chief executive officer Jeff Quartermaine said.

“Combined, our three West African gold mines are producing above our targeted rate of production with 535,281 ounces of gold produced in FY23, at a weighted average all-in site cost (AISC) of US$959 per ounce, a cost that is very competitive when compared to most of our global peers.”

Financially sound

Perseus recorded a commendable operating cash flow of A$648.3 million during 2023, equivalent to A47.44 cents per share and A$1,206 per ounce of gold.

Additionally, net tangible assets totalled A$1.7 billion or A$1.22 per share, marking a 41.1% increase from the previous year.

The gold producer reported a higher income tax expense of A$92.1 million compared to a A$200,000 benefit in the previous year, primarily due to improved profitability at the company’s Edikan Gold Mine in Ghana and withholding taxes paid on intercompany dividends from Côte d'Ivoire.

Depreciation and amortisation expense amounted to A$219.5 million, consistent with the prior year, and a notably lower write-down and impairment expense of A$9.4 million, compared to the A$43.4 million in 2022 was partially due to the A$7.6 million cost incurred as a result of assets damaged during the conflict in Sudan in June.

The company closed the year with a healthy cash and bullion balance of A$786.1 million, unencumbered by outstanding debt.

Bonus payout

Given the strong performance, Perseus announced a final unfranked dividend of 2.48 cents per share totalling A$33.9 million, which includes a bonus dividend of 1.77 cents per share, bringing the total dividend to 3.54 cents per share for an annual dividend yield of 2%.

“Our strong financial results have enabled us to add a bonus dividend to our final dividend for FY23, bringing our full-year dividend yield to 2%, without materially detracting from our balance sheet or importantly, our ability to fund future growth,” Quartermaine said.

“Since our maiden dividend distribution in August 2021, Perseus has returned nearly $100 million to its shareholders via dividends and we have done this while investing record amounts of money in the economies of our host countries and host communities and paying bonuses to our local and expatriate employees who have delivered these outstanding results.

“In other words, we are delivering on our corporate mission of generating material benefits for all of our key stakeholders in fair and equitable proportions, and we look forward to continuing this in the years to come.”

Gold outlook for the balance of 2023 is unchanged.

Eye on sustainability

Concurrently, Perseus released a sustainable development report for the first time, in which the company said it remains dedicated to the health and safety of its employees and contractors.

It paid particular focus on creating a safety culture centred around critical control management, visible leadership, care and accountability, and meaningful safety interactions during the year.

Looking ahead, the company will strengthen its sustainability strategy, with a focus on social performance policies, environmental risk management and governance enhancements.