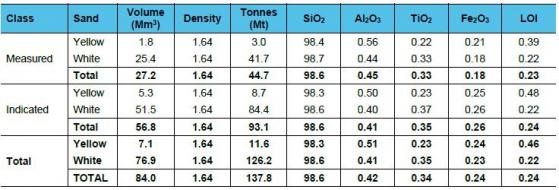

Perpetual Resources Ltd (ASX:PEC) has updated the mineral resource estimate (MRE) for the flagship Beharra high-grade silica sand project in Western Australia, which now stands at 137.8 million tonnes at 98.6% SiO2.

Significantly, 90% of the MRE comprises the high-quality Upper and Lower White horizons, which are estimated to include 126.2 million tonnes at 98.6% SiO2.

Measured resource

Within this is a measured resource of 41.7 million tonnes at 98.7% SiO2 and an indicated resource of 84.4 million tonnes at 98.6% SiO2.

Previous MREs only included up to the indicated category so the initial measured resource represents an important step forward.

Updated Beharra mineral resource estimate from December 2022.

The entire resource is located above the water table, which accurately reflects the mineable deposit.

This updated MRE was prepared by Snowden Optiro and follows the maiden estimates released in July 2020 and an update from March 2021.

“Best understanding of our deposit”

Perpetual’s chairman Julian Babarczy said, “We have worked thoughtfully and methodically to define what we believe is the highest quality mining horizons that will underpin the most valuable development scenario for the Beharra Project.

“This strategy, while having taken slightly longer than a more simplified program would have, puts Perpetual in the enviable position of having the best understanding of our deposit when compared to any of our peers, in our opinion.”

Highest-value horizons

The Upper and Lower white horizons contain the highest silica and lowest end product impurity profile within the Beharra orebody, with the updated MRE now specifically covering these high-quality horizons, which will be the focus of future development efforts for the Beharra Project.

Targeting these high-grade areas will not only ensure the highest quality end product is available to Beharra’s eventual customers but will also simplify the mining process as well as removing any environmental concerns that may be associated with a development scenario that interferes with the natural groundwater level in mining-affected areas.

Specifically, this MRE excludes those previously reported areas which are at or below the water table and which were found to result in lower-quality end product.

Beharra Project north-south section showing domain interpretation.

Easily upgraded

Perpetual has previously demonstrated the ability to upgrade Beharra silica sand to >99.5% SiO2 via the application of straightforward industry-standard processing methods, delivering a low-impurity end product for sale into the fast-growing Asia Pacific silica sand markets.

"Our metallurgical programs have focused on achieving the lowest impurity profile end product and has led to significant reductions in end product key impurities, such as iron oxide, over our journey of refinement,” Babarczy said

“This updated MRE demonstrates the enormous scale of our resource at Beharra and pleasingly, it confirms that our highest quality horizons, the Upper and Lower White sub-domains, contain enough sand to underpin a multi-decade project at Beharra.

"The scale of this updated MRE will also provide a ready source of high-quality sand tonnage to underpin the potential for project expansion, with this decision to be examined once we are an established provider of high-quality silica sand to the fast-growing Asian markets.”

Chip tray for drill hole AC-25.

The focus of the potential Beharra development will now centre on the southernmost portion of the mining licence, which contains the measured portion of the Updated MRE.

Further supporting this decision are both the block and seam models, which demonstrate that this region of the orebody contains the highest in-situ SiO2 content concurrent with the lowest in-situ Fe2O3 content.

Silica sands market

Silica sands have an extensive range of uses, with lower purity (

With increasing purity (>99.5% SiO2) and price, uses include glass making including ultra-clear glass, with one of the key determinants of the sand’s suitability for specific applications and pricing being the level of the key impurity iron oxide (Fe2O3).

Perpetual is targeting the high-growth Asia Pacific silica sand markets, where independent market assessments have calculated a 40 million tonnes per annum incremental market growth opportunity through to 2026.

Read more on Proactive Investors AU