Pental Ltd (ASX:PTL) expects to report higher revenue in the first half of the year as both its owned as well as contracted brands in Australia have performed well during the period, although New Zealand continues to be impacted by supply chain issues.

Revenue for owned brands is forecast to be 2% higher year-over-year in the six months to December 25, while contracted brand sales are forecasted to increase by about 10%. Revenue in the New Zealand market is expected to decline by 11%.

The branded home, hygiene and e-commerce product developer and supplier experienced significant cost pressures in the last 12 months from a rise in raw materials, including packaging used in its products, and sees an impact of $1 million to its bottom line.

In a trading update, Pental said it will report the first half results in February.

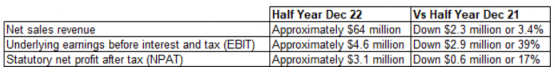

Consolidated results forecast, subject to audit.

H2 outlook positive

Conditions are improving, the company said, noting that its brands are performing strongly in the domestic market while supply chain conditions in New Zealand continue to improve.

Pental has implemented cost recovery strategies without impacting consumer pricing for the second half and expects to reduce the higher cost of production, including savings in energy costs and alternative sources of supply, through these measures.

Full-year 2023 underlying earnings before interest and taxes (EBIT) will be in the range of $7.5 million and $8.5 million, a decline of about 30% and 21%, respectively, from 2022.

The company expects to remain in a healthy cash position at the end of December, with an estimated $5 million in cash on hand along with $2.975 million of Hampers With Bite acquisition-related debt. It said this puts Pental effectively in a debt-free position.

Given its strong balance sheet and cash position, the company expects to pay shareholders an interim dividend of 1.3 cents per share in March, unchanged from the year-ago period.

Read more on Proactive Investors AU