A revised production plan on the Ross & Kendrick production areas within Peninsula Energy Ltd (ASX:PEN, OTCQB:PENMF) and subsidiary Strata Energy Inc’s 100%-owned flagship Lance Projects in Wyoming, USA, is complete and has production restarting in late 2024.

The revised strategy positions Peninsula as a fully independent, end-to-end producer of dry yellowcake, while delivering a robust and resilient project development plan for Lance, including an accelerated production ramp-up schedule.

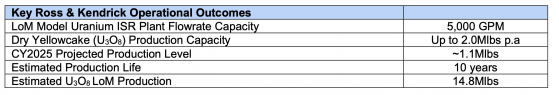

With this approach, PEN aims to bypass third-party processing vulnerabilities, noting that the new Ross & Kendrick Life of Mine (LoM) model features a complete 5,000 GPM uranium In-Situ Recovery (ISR) plant, to produce up to 2.0 million pounds per annum of dry yellowcake (U3O8) product.

In addition to securing operational resilience through an updated LoM model, Lance's revised production strategy also highlights a cost-effective approach. The plan maintains a competitive estimate for C1 Direct Operating Costs at US$21.69 per pound.

The remaining capital expenditure (capex to initiate the first production phase is slated at US$53.4 million. Furthermore, a supplementary capex of US$17.4 million has been earmarked for the ramp-up period, extending from the start of production to the achievement of full flowrate capacity.

Key operational results from revised production plan.

Key financial results from revised production and LoM plan.

Peninsula will begin construction activities for its expanded plant in late 2023, following final engineering and procurement work. Meanwhile, it will continue with Wellfield development and construction activities in advance of the production restart.

The company expects the project to be cash flow positive in its first full year of production (in 2025). It will continue to assess upfront capital, working capital and funding requirements.

All of PEN’s customers have indicated a willingness to revise near-term delivery schedules.

Operational integrity secured

With the newly updated LoM model for Lance, Peninsula has secured operational integrity by internalising the entire uranium yellowcake production process.

Based on a total resource base of 21.8 million pounds of uranium-235 (U3O8), the revised plan specifically targets Ross and Kendrick, sidestepping the adjacent Barber resource area.

The enhanced plant facilities will, however, accommodate future output from Barber's substantial 31.9 million-pound U3O8 reserve, indicating avenues for significant expansion for the Lance Projects.

The overall plant expenditure is calibrated against production from Ross and Kendrick, streamlining costs and underlining the project's robustness.

Peninsula’s managing director and CEO Wayne Heili said, “Peninsula remains committed to bringing Lance back into production as quickly as reasonably achievable. Our expert team has revised the Ross & Kendrick production area Life of Mine model to assess the impact of expanding the process plant with additional ion exchange, elution, precipitation and product drying functionality installed from the commencement of production.

"The new model is underpinned by a quality resource and detailed technical evaluations. The results generated demonstrate the favourable economic potential of Lance and importantly, confirm that the company is well positioned to move ahead with the plant expansion and production restart within the current dynamics of the uranium market.

“I am proud of the entire team at Peninsula who have worked extremely hard over the past month to deliver this plan, which will see operational activities restart at Lance in a little over 12 months.

"We have a world-class project, strong economic and operational numbers, and the team in place to establish Peninsula as a fully independent end-to-end producer of dry yellowcake.

"We have held productive discussions with all our customers and are appreciative of their flexibility and willingness to consider amending future delivery schedules resulting from our revised production schedule.

“Peninsula has a unique competitive advantage in being the only ASX-listed, US-based uranium company authorised to use the industry-leading low pH ISR method.

"Based on the advanced development stage of the project, Peninsula has a rapid pathway to complete the facility additions and to return Lance to production in late calendar year 2024.”

Robust economics

The updated LoM model for Lance's Ross and Kendrick production areas forecasts promising economic outcomes. According to the plan, the project will achieve a positive cash flow within the first year of production, estimated to be by September 2025.

With a 10-year operating mine life and an average production rate of 1.48 million pounds of uranium-235 (U3O8) per year, the Ross and Kendrick areas are projected to generate a Net Present Value (NPV) of US$116 million (2023 real terms) and an Internal Rate of Return (IRR) of 26%. A determined average sales price of US$67.07 per pound U3O8 contributes to an anticipated LoM revenue of US$988 million.

Life of Mine production profile.

In terms of costs, the all-in-sustaining cost (ASIC) is outlined at US$42.46 per pound, while the fully loaded all-in cost (AIC) stands at US$50.27 per pound. These competitive cost metrics further bolster the project's economic resilience as it prepares for production in late 2024.

What about sales?

PEN has contractually committed up to 4.95 million pounds of uranium-235 (U3O8) for delivery between now and the end of 2033. The contracts are priced at a weighted average of approximately US$55 per pound U3O8 in 2023 dollar terms. These contracted sales account for up to 34% of the planned LoM production from the Ross and Kendrick areas.

For the remaining uncontracted production, the company assumes a weighted average selling price of US$72.62 per pound U3O8 (2023 dollars, un-escalated).

Moreover, in light of the updated production timeline, PEN is talking with its existing customer base to revisit delivery schedules for calendar year 2023 and 2024. Customers have expressed a collective willingness to amend near-term delivery timelines, demonstrating flexibility and cooperation.

The company values this collaborative approach and will keep the market informed regarding any adjustments to its forward sales portfolio.

Funding outcomes and capital needs

PEN projects significant financial outlays between July 2023 and September 2025, the period anticipated for generating sustainable positive cash flows.

A total of US$19.3 million will be allocated for process plant modifications, while wellfield development capex is estimated at US$41.2 million.

This expenditure is aimed at ramping up the plant flow rate to approximately 5,000 gallons per minute by the second half of 2025.

Operational expenditure (opex) and site overheads are pegged at US$44.3 million, with a contingency and escalation allowance of US$9.4 million. Cumulatively, project-level expenditure is projected to reach US$120.1 million.

Additionally, PEN anticipates a requirement of US$22.3 million for corporate costs, non-project area exploration, and a working capital buffer. As of now, it has a cash balance of US$21.4 million and expects to net US$26 million from uranium sales, leading to a projected net additional funding need of US$95 million.

The funding is not required in a lump sum and may be sourced progressively over two years through various instruments, including the sale of strategic uranium inventory, equity, and debt.

The company's board is optimistic about securing necessary financing based on existing long-term uranium contracts, a successful track record in raising funds, and positive economic indicators from the revised LoM plan.

Read more on Proactive Investors AU