Peninsula Energy Ltd (ASX:PEN, OTCQB:PENMF) has completed a substantially oversubscribed securities purchase plan (SPP) for A$10 million after receiving applications totalling A$33.7 million from more than 2,000 eligible shareholders.

This SPP was part of a capital raising in which Peninsula also raised A$50 million in a placement to global institutional and sophisticated investors for a total of A$60 million.

The SPP allowed eligible shareholders to each subscribe for up to A$30,000 worth of SPP shares. Shares were offered at the placement price of A$0.075 per share, together with one free attaching option exercisable at A$0.10 for every two SPP shares.

As per the SPP terms, the company will only accept applications for A$10 million.

“Strategically positioned”

The A$60 million proceeds from the placement and SPP will be used to finance the company’s continuing construction works and wellfield development to restart production under the revised life of mine plan for the Lance projects in Wyoming, USA.

Peninsula managing director and CEO Wayne Heili said: “On behalf of the company, I would like to thank all participating shareholders for their strong support of the SPP to complete the capital raise of $A60 million.

“Peninsula is strategically positioned to capitalise on the increasing demand and prices for uranium. We remain on track and on budget for restart of dry yellowcake production by the end of 2024.”

The scale back

The SPP was strongly supported by eligible shareholders and was substantially oversubscribed, necessitating Peninsula to scale back applications. The company took into account a number of factors when determining the amount by which to scale back applications, such as:

- Applications received from ineligible shareholders were not accepted;

- Applications received from holders with multiple registered holdings (including both sole and joint holdings) exceeding $30,000 in aggregate were treated as one application for $30,000 of new shares;

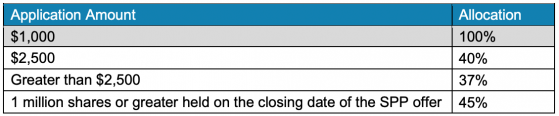

- Applications for A$1,000 received from eligible shareholders were not subject to any scale-back and received the full amount they applied for;

- Applications received from eligible shareholders of $2,500 or above were scaled back on a pro-rata basis to between 37%-40% of the amount applied for; and

- Applications from eligible shareholders who hold equal to or greater than 1,000,000 shares at the SPP closing date were scaled back to approximately 45% of the amount applied for.

The SPP shares and SPP options will be issued to applicants on January 31, 2024, together with the options under the recent placement.

Read more on Proactive Investors AU