Peninsula Energy Ltd (ASX:PEN, OTCQB:PENMF) has completed a positive Final Investment Decision (FID) to restart uranium production operations at the company’s flagship Lance Projects in Wyoming, US.

Lance holds a JORC (2012) resource of 53.7 million pounds of uranium (U3O8) which constitutes one of the largest uranium production development projects in the US.

It is the only uranium ISR (in situ recovery) project situated in the US that is fully permitted to utilise the low-pH ISR recovery process.

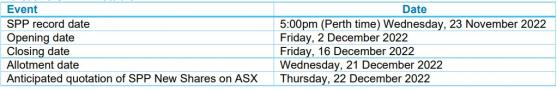

Further, the company has entered into an underwriting agreement with Canaccord Genuity (TSX:CF, LSE:CF) to conduct a fully underwritten institutional placement of shares to raise A$32 million and has also launched a non-underwritten SPP (share purchase plan) to shareholders to raise up to A$3 million at 13.1 cents per share.

Indicative SPP timetable.

Peninsula managing director and CEO Wayne Heili said: “It is with a tremendous sense of excitement that we are advancing the Lance Projects back into production.

“Our team has put an enormous amount of work over recent years into the transition to a low-pH ISR operation and we will be confidently moving forward to production.

“The underwritten placement supports the board’s investment decision and marks a great milestone for the company.

“Now, with this A$35 million equity issue, the preparatory works that have already completed, and the commencement of restart works, we are on a clear pathway to production commencing in Q1 of 2023.”

Use of funds

The proceeds of the placement and the SPP will be used to complete the ongoing works program of transitioning Lance to the low-pH ISR process, to restart production operations within the Ross Production Area and for the advancement of the Kendrick Production Area.

From late 2015 through mid-2019, Ross was operated as an alkaline ISR operation.

Peninsula completed substantial regulatory and technical de-risking activities to prepare Lance for a conversion from alkaline ISR to the more effective low-pH ISR operations between 2019 and 2021.

In February 2022, the company commenced a preparatory works program to allow for a rapid restart of operations following an FID.

Proceeds of the placement will be used to complete the transition works programs and to commence low-pH production operations at Ross.

Initial production activities are projected to commence in Q1 CY2023 with deliveries to existing customers starting in Q4 of CY2023.

In short, Peninsula is in a strong position to provide new supply to the growing nuclear fuel markets as Lance becomes fully operational.

Kendrick drilling

Peninsula will also use funds from the placement to advance the Kendrick Production Area.

The company anticipates funding a resource enhancement drilling program within Kendrick in CY2023.

Peninsula considers the area holds abundant exploration upside along with the potential to upgrade known resources from the inferred category to measured and Indicated categories.

Additionally, the company anticipates filing both license and permit amendment applications in December 2022 to include Kendrick along with Ross in the fully licensed area of the Lance Projects.

Peninsula remains debt free and has also retained its inventory of ~310,000 pounds of uranium in converter accounts, with a current spot market value of US$15.5 million (at US$50.00 per pound U3O8).

DFS results

In August, Peninsula released a definitive feasibility study (DFS) demonstrating a robust economic case for the company’s three Lance Uranium Projects – Ross, Kenrick and Barber.

Key results from the DFS include a life-of-mine (LoM) production of 14.4 million pounds of uranium, a gross revenue of US$895 million and a steady production rate of 2 million pounds of uranium per annum from the fourth year of production.

Economically, the DFS predicts a pre-tax net present value (NPV) with a discount rate of 8% of US$125 million and a 43% internal rate of return (IRR) based on an average sale price of US$62.38 per pound of uranium.

The DFS forecasts LoM all-in costs of US$45.74 per pound of produced uranium, with an all-in sustaining cost (ASIC) of US$29.08 per pound and a direct operating cash cost of US$16.34 per pound.

Read more on Proactive Investors AU