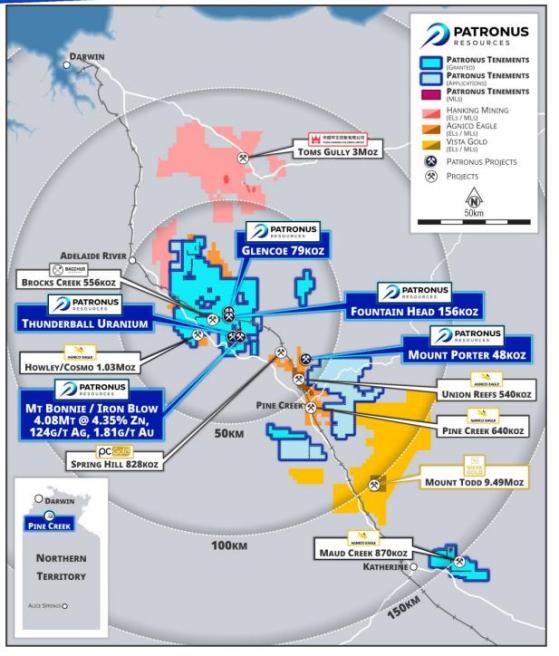

Newly minted Patronus Resources Ltd (ASX:PTN, ASX:KIN) boasts a smorgasbord of recent discoveries in the Northern Territory’s Pine Creek Orogen, where it is exploring for gold at Pine Creek and testing a high-grade uranium deposit at Thunderball.

Patronus’ broader growth strategy centres on its diversified multi-commodity portfolio, combining key assets in uranium, gold and base metals across the Northern Territory and Western Australia.

The company’s 2024 rebirth as Patronus, the result of a merger between KIN Mining and PNX Metals has consolidated its mineral resources, which now exceed 1.45 million ounces of gold, 16.2 million ounces of silver, and 177,000 tonnes of zinc.

Significant uranium potential at Thunderball

The Thunderball uranium deposit, discovered in 2009 by Thundelarra Exploration, has been a focus of interest for its exceptional high-grade uranium intersections.

Noteworthy drill results include 15 metres at 1.5% U₃O₈ from 139.0 metres, 11 metres at 3.4% U₃O₈ from 144.0 metres, and 15 metres at 1.35% U₃O₈ from 210 metres.

These historical results demonstrate Thunderball’s potential as a world-class uranium deposit, positioned within an underexplored region with strong future upside.

Since 2014, exploration at Thunderball had slowed, but Patronus has reignited efforts with the support of co-funding from the Northern Territory government to drill a deep hole some 450 metres down-dip of the historical mineral resource.

A 2024 gap analysis by SRK Consulting confirmed that existing probe data are suitable for mineral resource estimate (MRE) work and identified immediate and regional targets with significant exploration upside.

The plan is to conduct further drilling to expand Thunderball’s resource base, with a view to upgrading the mineral resource to JORC 2012 status.

Expanding uranium prospects and Pine Creek growth

The Pine Creek Orogen, known for its rich mineralisation, continues to offer substantial growth opportunities for Patronus.

Patronus has 100% control of more than 1,500 square kilometres of granted mining leases and exploration licences in the district, with established infrastructure that enhances the viability of its projects.

At the Fountain Head and Glencoe deposits, Patronus holds 283,000 ounces of gold across measured, indicated, and inferred resources, including 2.9 million tonnes at 1.7 g/t gold at Fountain Head and 2.1 million tonnes at 1.18 g/t gold at Glencoe.

Both deposits have strong near-term development potential, with Fountain Head’s Environmental Impact Statement already approved and a Mine Management Plan pending.

Patronus is also focusing on expanding its exploration program across other prospects in the Hayes Creek Uranium Field, which has historically yielded significant results.

Flagship projects in Western Australia include the Leonora gold assets, where recent drilling at the Mertondale and Cardinia deposits expanded the company’s gold resource inventory.

This inventory includes 11.7 million tonnes at 1.22 grams per tonne (g/t) gold for 457,000 ounces at Mertondale and 10.4 million tonnes at 1.42 g/t gold for 475,000 ounces at East Cardinia.

With mining proposals in progress and new drilling underway, Patronus expects further resource upgrades and development opportunities in the region.

Base metals and future opportunities

In addition to gold and uranium, Patronus is making strides in its base metal exploration, particularly through its Hayes Creek Project.

This project boasts a substantial mineral resource of 4.1 million tonnes at 4.35% zinc, 124 grams per tonne silver, and 1.8 grams per tonne gold, providing a significant boost to the company’s zinc and precious metals inventory.

Recent base metal discoveries in the Leonora region have also yielded promising results, with a new volcanic-hosted massive sulphide (VMS) system uncovering 5.7 metres at 5.3% zinc, 40 grams per tonne silver, 1.0 grams per tonne gold, 0.3% copper, and 0.3% lead from 270.3 metres.

This discovery signals strong potential for future high-grade mineralisation in the region.

Positioned for future growth

With a robust balance sheet exceeding A$80 million, Patronus is well-positioned to capitalise on its multi-commodity platform and advance its projects in both the Northern Territory and Western Australia.

The company’s diversified approach, targeting gold, uranium and base metals, provides shareholders with exposure to a range of growth opportunities in Tier-1 jurisdictions.

Patronus Resources’ next steps include ongoing drilling at Thunderball, as well as further resource upgrades and development planning at its Leonora gold and Pine Creek base metal projects, positioning the company for continued success in Australia’s highly prospective mineral regions.

Read more on Proactive Investors AU