Pantoro Ltd (ASX:PNR) is aiming to raise $25 million as part of an institutional placement that may also accept oversubscriptions for a further A$5 million.

The company will also launch a Share Purchase Plan (SPP) targeting a maximum of A$5 million (before costs). The SPP is not underwritten and there is no guarantee the company will raise the full $5 million.

New shares will be issued at a price of $0.145 per share. This represents a 14.7% discount to the last closing price of $0.170 on October 19, 2022; and a 19.6% discount to the 5-day VWAP of $0.180 on October 19, 2022.

Where the money goes

Pantoro will use the money raised, along with existing cash to:

- support the Norseman Project ramp up;

- working capital;

- balance sheet buffer; and

- contingency and offer costs.

A brand-new processing facility was constructed with practical completion achieved on September 5 and first gold poured on October 13, 2022.

Mining is underway at the Scotia Mining Centre and OK Underground Mine with significant ore stocks available for processing on the ROM.

The current mineral resource is 4.8 million ounces of gold with an ore reserve of 973,000 ounces.

Hitting key milestones

Pantoro managing director Paul Cmrlec said of the raise and the first gold pour: “The Norseman Project reached a key milestone on October 13, 2022, with the pouring of first gold.

“The construction of the Norseman Project has run very smoothly considering the wider macroeconomic and COVID-19 issues which have affected the industry over the last year.

"Construction was completed on time and on budget, however delays experienced while commissioning, together with the impacts of COVID-19 at Halls Creek, have driven the company to strengthen its balance sheet as it moves through ramp-up to full production rates.

“Despite these commissioning delays, the plant is now running well with daily throughput over 100 tonnes per hour and ramping to the full 125 tonnes per hour run rate.

"Mining operations are continuing in accordance with the plan, with significant ROM stocks available for processing.

"On completion of the equity raising we will have a strong balance sheet that will see us through to positive cashflow at Norseman which we expect in the January 2023 quarter,” he said.

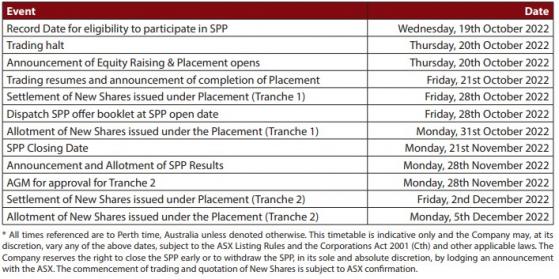

Timetable

The following indicative timetable lays out the capital raising timeline: