Orion Minerals Ltd (ASX:ORN, JSE:ORN) welcomes the acquisition by Industrial Development Corporation of South Africa (IDC) of a 43.75% interest in New Okiep Mining Company Proprietary Ltd (NOM), marking a major step towards the planned restart of mining operations at the advanced Okiep Copper Project (OCP).

With the completion of the acquisition, the South African government-owned financier will now advance its pro-rata share of ZAR35 million of the total budgeted pre-development operating costs to NOM. The initial funding of ZAR22 million is expected shortly.

Orion owns the remaining 56.25% of NOM and has already advanced its entire pro-rata share of ZAR44 million to NOM.

Ownership by Historically Disadvantaged South Africans

Orion announced in September that NOM is acquiring the prospecting as well as the mining rights at OCP from Southern African Tantalum Mining Proprietary Limited (SAFTA), in which the IDC is currently a 43.75% shareholder.

Once NOM secures the SAFTA assets, the IDC will sell 22.22% of its shares in the subsidiary to a Black Economic Empowerment (BEE) entity, led by resource magnate Lulamile Xate.

Subsequently, community and employee trusts will take up a 5% interest in NOM, resulting in 30% of the company being owned by Historically Disadvantaged South Africans (HSDAs).

The definitive HDSA ownership arrangements are now expected to be finalised and executed in the coming months.

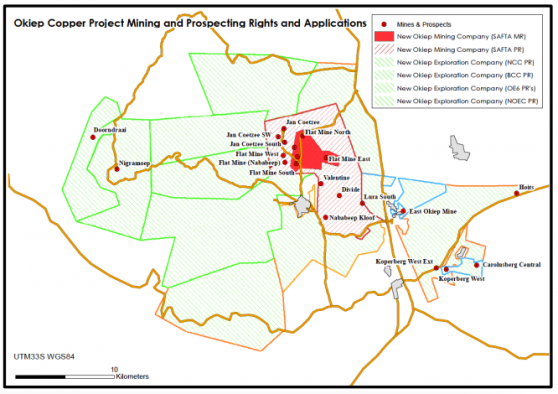

Location of the OCP mineral rights and NOM-SAFTA mining and prospecting rights.

Positive scoping study

A scoping study for the SAFTA area completed by Orion has recommended a moderate-scale start-up mining operation on known, drilled copper deposits.

Feasibility studies upgrading the 2021 scoping feasibility study for the OCP are well advanced, with targeted completion in the second quarter of next year.

Delivering shareholder value

Orion managing director and chief executive officer Errol Smart said: “We are very pleased with the swift progress that has been made in completing our NOM deal with the IDC.

“We have signed definitive agreements, met all conditions precedent and have issued the draw-down notice for funding – all in less than two months after signing non-binding term sheets with the IDC. We commend and thank the IDC for the professionalism, commerciality and vigor with which they participated in this process.

“Orion, the IDC and Lulamile Xate’s BEECo all share a common vision to fast-track the feasibility studies, permitting and early development of the Flat Mines Project at Okiep, with a view to restarting mining operations in this richly endowed copper district as soon as possible.

"The bankable feasibility study is already at an advanced stage and is expected to be completed and submitted for independent peer review in the first quarter of 2023.

“While the NOM-IDC deal has been progressing, our team has also been working in parallel on the definitive agreements with the IDC for the ZAR250 million funding of the Prieska Project, announced on October 21, 2022, and we expect completion of that agreement in the near future.

“Our growing business relationship with the IDC as a key development partner in unlocking the significant base metal potential of the Northern Cape will also position us to deliver value for our shareholders, our host communities and our staff, who will also be shareholders in our mines.”

Orion views the OCP as a significant growth opportunity, with the potential to become its second base metal production hub in the Northern Cape, alongside its flagship Prieska Copper-Zinc Project, located 450 kilometres east of the OCP.

Read more on Proactive Investors AU