ASX- and JSE-listed Orion Minerals Ltd (ASX:ORN, JSE:ORN) has upgraded the mineral resource for the Flat Mines Area within the Okiep Copper Project (OCP) in the Northern Cape Province of South Africa to 12 million tonnes grading 1.4% copper for 160,000 tonnes of contained copper, strengthening confidence in support of a bankable feasibility study (BFS).

This follows a detailed review of the geology and remodelling of the project’s Flat Mine North (FMN), Flat Mine East (FME) and Flat Mine South (FMS) deposits that resulted in the expansion of their combined resources to 9.3 million tonnes grading 1.3% copper for 130,000 tonnes of contained copper.

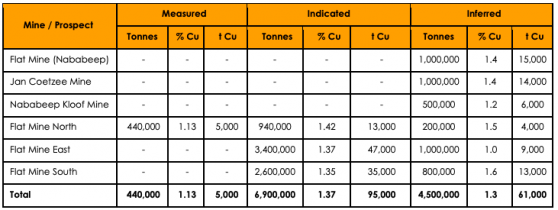

OCP’s mineral resource estimate (MRE), completed using historical drilling data, also includes the 2.5 million tonnes at 1.4% copper resource defined for Flat Mine (Nababeep), Jan Coetzee Mine and Nababeep Kloof Mine in 2021.

Greater confidence

“Following a detailed geological review, we have been able to deliver an increase in the total mineral resource for the Flat Mines Area and, more importantly, greater confidence in the resource model,” Orion managing director and chief executive officer Errol Smart said.

“This is a very positive result which has now been incorporated in the bankable feasibility study (BFS) for the Okiep Copper Project.

“We have now concluded the main body of work for the BFS and we are in the process of handing the study to the Independent Technical Expert appointed by the debt advisor for the project on behalf of the Industrial Development Corporation of South Africa Ltd and debt financiers who have expressed an interest in funding the project.

“The BFS outcomes will be released to the market once the Independent Technical Assessment has been completed.”

“Outstanding” growth potential

The MRE for the FMN, FME and FMS deposits includes 7.4 million tonnes grading 1.4% copper categorised as measured and indicated and 2.0 million tonnes grading 1.3% copper as an inferred resource.

Several other historical mines and prospects are also being modelled, with the potential to deliver further growth in OCP’s resources.

Total mineral resource statement for the Flat Mines Area.

“While this initial resource has been utilised to support a foundation stage BFS and economic assessment of the Okiep Copper Project, we are confident in the potential to expand these resources with future drilling into the mineralised envelopes,” Smart said.

“We see outstanding potential to further grow and upgrade the mineral resources with infill drilling into areas with low drill density as well as drilling potential plunge and strike extensions of the known deposits.

“Most importantly, we are pleased to have concluded the tailings facility design, together with completion of water management plans in order to submit an application for an Integrated Water Use Licence.

“This element of the BFS work has proven to be the most time-consuming due to Orion’s focus on high ESG standards,” he added.

Read more on Proactive Investors AU