Orion Minerals Ltd (ASX:ORN, JSE:ORN) has struck a deal with the Industrial Development Corporation (IDC) of South Africa to advance its Okiep Copper Project in the Northern Cape.

Under the non-binding term sheet, the government-owned financier will facilitate Black Economic Empowerment (BEE) ownership and fund almost half of the pre-development costs tied to the copper play.

How will it work?

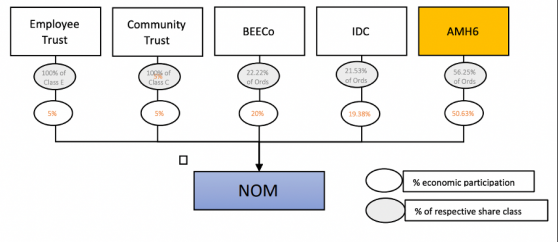

The IDC will start as a 43.75% shareholder in Orion subsidiary New Okiep Mining (NOM), in which the ASX-lister boasts a 56.25% holding.

Once it becomes a stakeholder, the IDC will provide ZAR34.579 million to support Okiep’s ZAR79.037 million pre-development budget, calculated in accordance with its 43.75% holding.

NOM is also acquiring the prospecting rights and the recently granted mining right from Southern African Tantalum Mining (SAFTA), in which the IDC is also a 43.75% shareholder.

Once NOM secures the SAFTA assets, the IDC will sell 22.22% of its shares in the subsidiary to a BEE entrepreneurial entity, led by resource magnate Lulamile Xate.

After that, community and employee trusts will take up a 5% economic participation interest in NOM, meaning 30% of the company will be owned by Historically Disadvantaged South Africans (HSDAs).

This is particularly important because South Africa’s mining charter sets out HSDA ownership objectives, encouraging historically disadvantaged empowerment partners to play an active role in project ownership and development.

Orion, the IDC and Lulamile Xate hope to finalise and execute definitive agreements to facilitate the HDSA ownership arrangements within the next two months.

The development partners will also cross the T’s and dot the I’s on what’s needed to support the IDC funding drawdown by October 31.

In tandem, Orion says feasibility studies, which are working to upgrade 2021’s Okiep scoping study, are well underway and slated for completion in quarter two next year.

Future NOM ownership structure.

“On solid footing”

Orion Minerals CEO and managing director Errol Smart said the company was delighted to reach the agreement soon after securing the mining right for the Flat Mines area at Okiep.

“With Orion already having contributed ZAR44.458 million, representing 56.25% pro-rata portion of the total predevelopment budget, the IDC has now agreed on the key commercial terms on which it will fund the balance of the budget to complete feasibility studies by June 2023,” he explained.

“Having also received the long-awaited grant of the mining right to the core area, we are finally able to complete the required drilling and metallurgical sampling to finalise the optimisation of the feasibility studies, which are already well advanced.

“The future ownership of NOM with high-quality development partners, such as the IDC, Lulamile Xate and our employees and host community, puts the Okiep Project on a very solid footing for the near-term development of what we expect to be a very exciting brownfields copper mining project.”

Read more on Proactive Investors AU