Orion Minerals Ltd (ASX:ORN, JSE:ORN) has reached an agreement with Mora Plase Proprietary Limited to access and acquire the surface ownership rights of 12,156 hectares at its Okiep Copper Project in Northern Cape, South Africa.

The acquisition clears the way for drilling to provide additional resource classification geotechnical and metallurgical zonation information for the New Okiep Mining Project.

Notably, surface right ownership also removes any conflict of interest in future surface use, allowing outstanding environmental authorisations and water use licence and rezoning applications to proceed to completion.

Previous lack of surface access has prevented drilling to provide final validation of data for the bankable feasibility study (BFS) on the Flat Mines deposits that are on this land.

“Very important milestone”

Orion managing director and CEO Errol Smart said: “This is a very important milestone for the New Okiep Mining Project.

“As a result of this acquisition, Orion now finally has clear access and exclusive use of the surface rights without any conflict with the surface owner to facilitate the development of the Flat Mines Mining Project.

“Conflicting land use interests have until now prevented Orion from accessing the surface area to conduct minor but important validation work to finalise the Flat Mines Bankable Feasibility Study.

“While the primary access for the deposits is located on municipal land – where we do have an access agreement – important supporting infrastructure such as roads, power transmission, water supply pipelines and, most importantly, ventilation holings will need to be located on the surface, within the newly acquired area.

“The acquisition of surface rights also gives us the flexibility and required surface access to undertake future extensional drilling of the known deposits and resource categorisation drilling.”

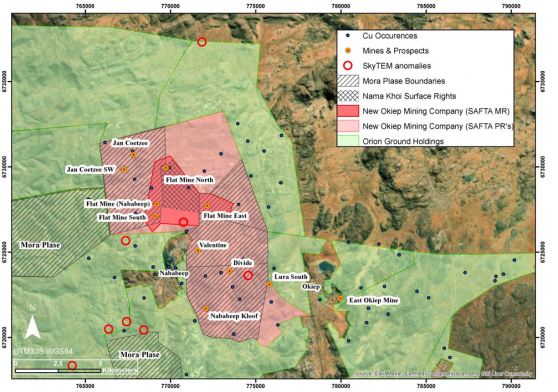

Location of the Flat Mines Project and Farms Nababeep surface rights acquired.

Forward plan

Orion has mobilised drill rigs to execute a 3,000-metre twin-hole drilling program over the Flat Mines East and Flat Mines North deposits and conduct confirmatory geotechnical and metallurgical test work.

The drilling and test work will be completed in the current quarter, with the results to be incorporated into an optimised BFS that will be externally reviewed in the following quarter before release scheduled for June 2024.

As a result of the removal of objections arising from potential conflicts in surface use of the area, Orion’s application for environmental and water right permitting over the Flat Mines and the surrounding prospecting rights will now also be allowed to progress to completion.

The mining rights and prospecting rights surrounding the granted mining right contain 18 known mineralised bodies that are mapped and drilled by Newmont and Goldfields.

Although 15 of these mineralised bodies will not be incorporated into the initial BFS, they provide an important upside to increase the scale of mine production and extend the life of mine.