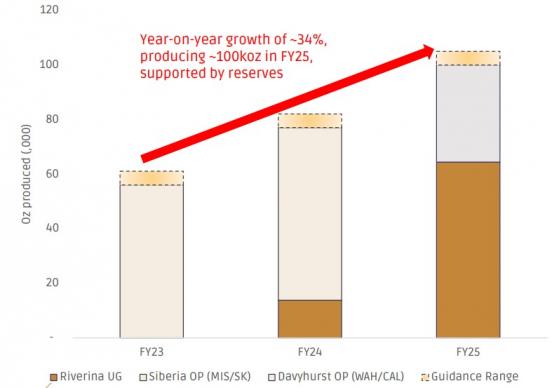

Ora Banda Mining Ltd (ASX:OBM) is on track to achieve its production target of 100,000 ounces of gold per annum by FY25 following the doubling of underground gold resources at the Riverina Project along with an increase in mining and processing performance.

The 100,000 ounces production target is underpinned by the recently upgraded maiden ore reserve of 73,000 ounces averaging 4.3 g/t at Riverina Underground in Western Australia's Goldfields.

Production forecast - FY23 to FY25.

The portal location for the underground mine is exposed and ready, approvals are in place and notification for mining has been sent with the ability to start from 27 March 2023.

Further production and reserve growth are expected at Riverina, supported by the upgraded underground resource of more than 300,000 ounces open in all directions.

It is worth noting that Ora Banda’s phase 1 exploration program has drilled 24% more holes in the six months from Jul -22 to Dec -22 than the entire amount of diamond drilling at Riverina Underground from 1984 to 2021.

Ora Banda has planned a phase 2 drilling program starting this month targeting extensions to the mineralisation envelope further south and at depth.

The company is also looking to restart exploration at Callion and Siberia as it sets its sights on a second underground mine.

Ora Banda’s resource update proves the case for its three-year strategy to pivot from open pits to explore for high-grade underground mines.

Ora Banda tenure and simplified geology.

Mining performance

Ora Banda’s mining performance at the Missouri open pit mine improved significantly in the December quarter, with a 27% improvement in mining volume compared to the September quarter with the same fleet.

This was a result of key operational and technical changes that were also key drivers in the increase in ounces mined of 33% quarter-on-quarter.

Missouri open pit mining - standards and operating practices improved resulting in 27% productivity improvement in the December quarter.

Importantly, the open pit sequence is advanced to higher grade zones, which is expected to deliver a ~30% improvement in ounces and grade in H2 compared to H1.

In addition, the strip ratio continues to reduce throughout 2023, further improving the economics of the open pit.

Processing

Investment in key projects and increased focus on operating parameters delivered substantial improvements to the Davyhurst processing plant in the December quarter.

The Davyhurst Processing plant - tonnes processed increased 11% in the December quarter.

Overall, ~292,000 tonnes were processed, representing an 11% increase from the September quarter and just short of the nameplate of 1.2Mtpa.

Key improvements were demonstrated by record process plant throughput in December of 109,000 tonnes, whilst also achieving a ~97% reduction in mill scats through optimisation of circuit.

Read more on Proactive Investors AU