Olympio Metals Ltd (ASX:OLY, OTC:COPGF) has made substantial progress across its portfolio of lithium, rare earths and gold projects in Australia and Canada over the last few months, paving the way for positive news in 2024.

The Peth-based explorer is led by managing director Sean Delaney, a mining industry veteran with more than 27 years of board and executive-level experience.

Let’s take an in-depth look at Olympio’s projects and the progress it has made.

Eurelia Project

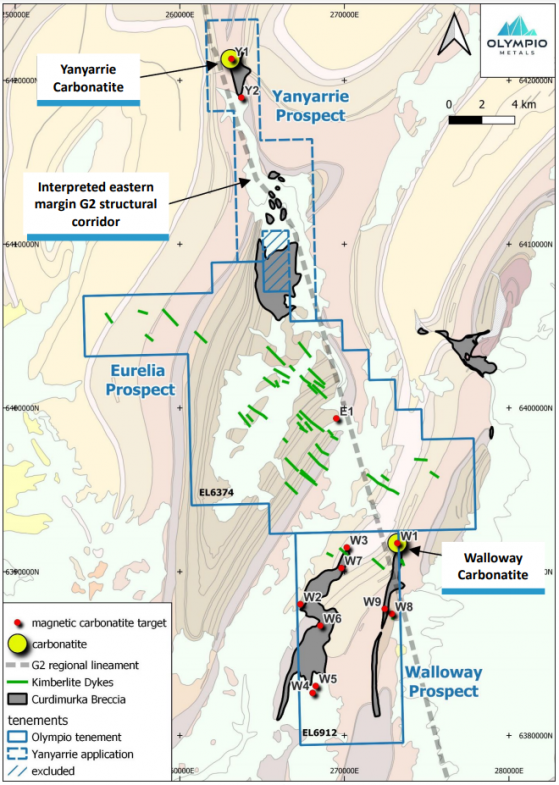

The Eurelia Project is within the Adelaide Geosyncline in South Australia and encompasses a large area prospective for carbonatite-hosted REE (rare earth elements) mineralisation.

Last month, Olympio started a drilling program at the Walloway Prospect within Eurelia.

The drilling is designed to test several high-priority magnetic carbonatite targets defined in a recent detailed aeromagnetic survey.

Magnetic modelling of the carbonatite targets has revealed robust magnetic models, with typically shallow depth to source (500 metres below surface).

Moreover, recent ultrafine fraction soil sampling over selected targets has revealed several areas of notable REE anomalism, spatially correlated with the magnetic targets.

Olympio’s Eurelia Project.

Olympio managing director Sean Delaney said: “We are excited to start our maiden drilling campaign on our 100% owned Walloway Prospect.

“This is the first opportunity to test the rare earths’ potential in an area with a known carbonatite source and this first pass drilling will narrow our focus on the multiple magnetic targets.”

Drilling underway at Walloway.

Cadillac Lithium Project

Olympio is advancing the Cadillac Lithium Project in the rapidly emerging Cadillac-Pontiac lithium camp in the Abitibi Témiscamingue region in Québec, Canada.

In November, a new LCT (lithium-cesium-tantalum) pegmatite outcrop (Dyke Z) was discovered at Cadillac, measuring 1.3km long and up to 150m wide, providing the scale for a potentially significant discovery.

A number of large-scale pegmatites in the Dyke M zone have also been identified as priority targets for drilling.

Delaney said: “Our exploration teams have used the XRF and LIBS analysers in the field to great effect. I visited the Cadillac Project last week and inspected a number of the targets in the field, including Dyke Z, with the Explo-Logik field team and experienced Canadian geologist Jean Lafleur.

Explo-Logik field crew on Dyke Z at Cadillac Lithium Project.

“It was great to see first-hand the scale of the targets, especially Dyke Z, which is a very large, raised topographic feature, largely covered in moss and vegetation.

“These targets are all close to the known spodumene occurrences at Wells-Lacourcière which provides confidence that we are in the right area. We are currently planning our first drilling program and working on the approvals process.”

Mulwarrie Lithium Project

Olympio and Liontown Resources (ASX:ASX:LTR) have elected to progress to the stage 1 earn-in phase of the two-stage farm-in arrangement at Olympio’s Mulwarrie Lithium Project.

The Mulwarrie JV project is in the prolific Goldfields region of Western Australia just 120 kilometres northwest of Kalgoorlie.

Mulwarrie is in the same geological setting as Delta Lithium Ltd (ASX:DLI)’s Mt Ida lithium deposit to the north.

Ora Banda Mining Ltd (ASX:OBM)’s significant Davyhurst lithium discovery is also located to the south of the Mulwarrie JV project, with OBM recently divesting 65% of the lithium rights at Davyhurst to Wesfarmers (ASX:WES) for up to $45 million.

Liontown elected to progress to stage 1 following promising soil sample results across the Mulwarrie Lithium Project highlighting several anomalous trends that require follow up assessment.

Liontown can earn a 51% interest in the project by spending A$400,000 on exploration over a period of twelve months (stage 1 farm-in).

Delaney said: “We are very pleased that Liontown has decided to progress the farm-in agreement following the return of promising results from the soil sampling program.

“Olympio still retains significant exposure to any discovery success, as the company has the ability to contribute to funding and remain at 49% once the stage 1 farm-in is completed.”

Halls Creek

Olympio’s Halls Creek portfolio comprises six granted exploration licences in the Kimberley Region of Western Australia and is accessed from Halls Creek via the Great Northern Highway.

In October, Olympio revealed assay results from the reverse circulation (RC) drill program completed at the Woodward Range Project.

The drill program was designed to test several historical high-grade gold (Au) and arsenic (As) soil anomalies which were confirmed with rock-chip sampling in June and August 20221.

Olympio intersected a number of anomalous quartz-haematite veins hosting gold mineralisation up to 18.60g/t Au.

Further mapping and sampling are now required to determine the geometry and extent of the gold mineralisation, which is scheduled to start in 2024.

Geological map of Halls Creek showing Olympio prospects.

Delaney said: “The drilling at these three prospects has successfully intersected a number of very high-grade gold zones that require follow-up mapping and sampling in order to determine their significance.

“Olympio’s current focus is on our Quebec lithium project and the Eurelia rare earths project in South Australia and our plan is to undertake follow-up work on the Halls Creek project in Q2 2024.”

Read more on Proactive Investors AU