Global oil markets are exhibiting signs of tightening supply and strong demand, fanning discussions among traders and analysts about the likelihood of crude oil prices touching the $100 per barrel mark.

To make matters worse, the surge is pushing inflation up at a time when many were hoping that central banks were on the verge of a more dovish approach to interest rates.

$100-a-barrel on cards

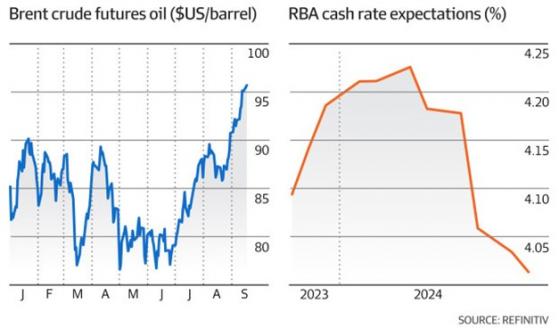

Crude oil is currently trading in the mid-$90s, a more than 30% increase since its low point in March. The uptick comes amid production cuts by key players like Saudi Arabia and Russia, causing a surge in premiums for physical barrels globally.

Chevron (NYSE:CVX) chief executive Mike Wirth suggested in an interview that oil reaching $100 a barrel was a real possibility.

The rising confidence in higher oil prices is also shown by recent trends in oil futures. Specifically, the contract for Brent crude to be delivered next month is more expensive by more than $1 a barrel compared to the following month.

This situation, known as "backwardation," is at its most pronounced level since November, indicating that oil is in high demand and short supply.

Geopolitical risks, particularly in oil-producing nations like Libya and Nigeria, are adding to the upward pressure on oil prices.

Citigroup (NYSE:C) analysts note that while geopolitics could temporarily push oil over $100, they foresee a loosening in the market in the long run due to growth in supply from non-OPEC+ countries such as the United States, Guyana and Brazil.

The Reserve Bank of India (RBI) warns that oil prices above $90 a barrel pose a new risk to global financial stability. Analysts are now increasingly focusing on the implications of these elevated oil prices on global interest rates.

RBA's hand may be forced

Some observers are now tipping that the Reserve Bank of Australia (RBA) could raise its cash rate to 4.35% from the current 4.1% by November.

This speculation adds another layer of uncertainty, especially as central banks globally, including the US Federal Reserve and the Bank of England, are expected to maintain a hawkish stance on interest rates.

The surging oil prices not only trigger inflationary concerns but also cast a spotlight on the sustainability of current levels of demand, particularly as refined fuels like petrol and diesel have already been trading above $100 for months.

This delicate balance between supply and demand dynamics and geopolitical influences forms the backdrop against which the oil markets will evolve in the coming months.

Read more on Proactive Investors AU