OD6 Metals Ltd (ASX:OD6) has started the third phase of drilling in search of the “best of the best” mineralised zones to expand its flagship Splinter Rock clay-hosted rare earth project in Western Australia.

This 188-hole program for 10,000 metres will test the length of the main prospects by up to 20 kilometres as well as determine the continuity of grade and thickness of the extensions.

The clay basin targets, their expanse and potential thickness were identified using an airborne electromagnetic (AEM) survey.

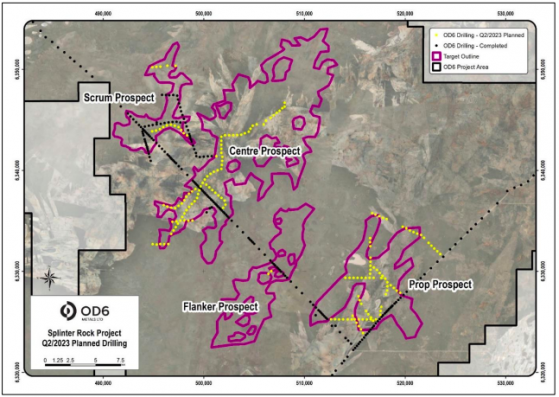

Splinter Rock planned drilling locations.

Completion in August

The Phase 3 drill program, partly funded by the WA Government’s Exploration Incentive Scheme (EIS), expands on the 262 holes for 10,167 metres completed so far.

Phase three is expected to take six to eight weeks to be completed, subject to seasonal conditions.

Assays are likely to be available towards the end of the third quarter.

Double the drilling

OD6 managing director Brett Hazelden said: “The success of our drilling programs at our flagship Splinter Rock Project, since listing on the ASX a year ago, has exceeded our expectations.

“This third phase program aims to significantly expand on the length of the main prospects as we target our strategy of pursuing the ‘best of the best’ zones within these high-quality REE clay basins.

“The new drill program is set to nearly double the amount of drilling conducted up until now, is targeted using our highly-effective AEM data, and we anticipate expanding our clay-hosted rare earths discovery even further.”

Read more on Proactive Investors AU