Oar Resources Ltd (ASX:OAR) has picked up two more tenements linked to its newly acquired Denchi Lithium Project in WA’s Northern Goldfields.

The tenements, which were recently under application, have since been granted — paving the way for an aggressive exploration campaign across the lithium property.

Aggressive exploration

Oar returned to the field last week, kicking off a systematic program over all three tenements.

CEO Paul Stephen said: “It is pleasing to see this rapid progress and to be able to mobilise our field team within just a few weeks of agreeing to the terms of sale with Denchi.

“Historical sampling and our own initial exploration work have already demonstrated the project is prospective for our targeted minerals and we look forward to making rapid progress as Oar repositions to focus on building its critical minerals portfolio.”

Oar’s campaign is designed to broaden the team’s understanding of Denchi’s pegmatites and identify other targets for future exploration.

It’s still early days, but feedback suggests numerous lithium-caesium-tantalum (LCT) pegmatites exist within the tenements — a finding that could support a maiden drilling program in early 2023.

The story so far

Oar picked up the Denchi project in early November, adding another 217.7 square kilometres to its exploration tenure.

At the time, executive director Chris Gale said the project would complement the company’s battery metals strategy.

“OAR currently has a graphite project in South Australia and now with a lithium project in our stable, we have two key battery metal elements to focus on, then hopefully develop to the next stage of drilling out a resource,” he explained.

The Denchi Project is also close to large, established lithium projects. Historical data — teamed with Oar’s initial reconnaissance program — indicate the property could host LCT pegmatites.

“We see this project as a valuable addition to our stable of critical mineral assets that are in demand globally as the race for renewables continues to accelerate,” Gale concluded.

New tenements

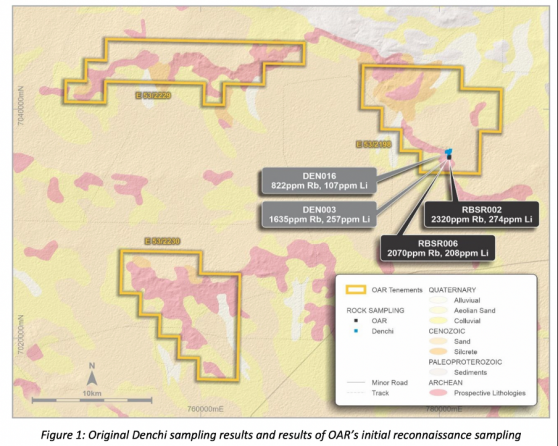

Tenement E53/2198 was already granted when Oar picked up the lithium project. Now, two more tenements — E53/2229 and E53/2230 — join the fold.

Ultimately, the grants trigger additional payments (as outlined in the acquisition release), but they also greenlight the field team to begin detailed exploration across the entire project area.

Oar is hoping to find LCT pegmatites consistent with those found at other hard rock lithium projects, such as Pilbara Minerals’ Pilgangoora project and Talison’s Greenbushes operation.

Sample says

Historical lithium and rubidium anomalies, along with other minerals common in LCT pegmatites, were recorded in rock chips taken in 2019, which Oar received from previous owner Denchi Pty Ltd.

During initial reconnaissance, the field team picked up 16 more rock chips around past anomalies and up to 500 metres north.

Promisingly, the team was able to replicate the historical anomalism and expand the LCT mineralisation further to the north, with the last sample (DEN016) showing elevated levels of elements common in LCT pegmatites.

Read more on Proactive Investors AU