Investing.com - NVIDIA Corporation (NASDAQ:NVDA) is scheduled to release its fiscal Q1 2025 earnings after the trading session concludes on Wednesday.

Market watchers are particularly interested in the sustained expansion of its data center division and any new information about the recently launched Blackwell platform.

Analysts' consensus estimates, predict that Nvidia's Q1 2025 revenue will reach $24.53 billion. This marks a substantial increase from the prior quarter and over triple the revenue generated during the same timeframe last year.

The company's net income is projected to rise to $12.91 billion, exceeding the previous quarter's figure and significantly outpacing the $2.04 billion profit reported in the same period a year earlier. Analysts also forecast that the diluted earnings per share (EPS) for Q1 will be $5.58, a considerable jump from the 82 cents per share reported in the same quarter of the previous year.

Nvidia has effectively leveraged the surge in artificial intelligence (AI) applications, even earning a mention from OpenAI, the creators of ChatGPT, at their recent GPT-4o launch.

The company's data center division has experienced rapid growth due to the heightened demand for its high-performance computing chips that are designed to handle AI tasks. The division's revenue soared to a record $18.4 billion in Q4, breaking the record set in the prior quarter and representing a fivefold increase from the same period a year earlier. Nvidia estimated that AI inference contributed to approximately 40% of its data center revenue in fiscal 2024.

In a letter to shareholders, CEO Jensen Huang noted that Nvidia's solutions can significantly decrease both costs and power consumption for data centers optimized for throughput.

Company Focus: The Blackwell Platform

Nvidia unveiled its latest AI-centric technology, the Blackwell platform, at its annual GPU Technology Conference (GTC) in March.

The Blackwell platform boasts the Blackwell GPU, touted by Nvidia as the "world's most powerful chip," new Tensor Cores designed for large language model (LLM) inference, new accelerators, and the GB200 Grace Blackwell Superchip.

While Nvidia hasn't provided specific details about the pricing or general availability of the new system, it announced that Blackwell would be available via its partners, including Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Alphabet's (NASDAQ:GOOGL) Google, later in the year.

Analysts believe that Nvidia will continue to face the challenge of meeting the skyrocketing demand for its AI-enabled chips.

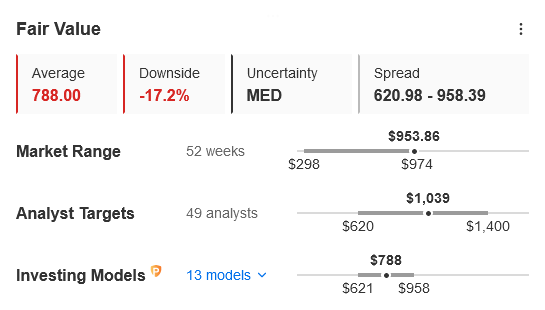

Nvidia shares have seen remarkable growth since the start of the year, nearly doubling in value and trading at $948.30 as of 11:45 a.m. ET on Tuesday.