Novo Resources Corp (TSX:NVO, OTCQX:NSRPF, ASX:NVO) has welcomed further progress in ongoing lithium exploration at the Quartz Hill Joint Venture in the Eastern Pilbara, Western Australia, which it shares with Liatam Mining Pty Ltd in a 20-80 split.

This follows a series of successful ground-truthing activities carried out by partner Liatam at the tenements.

The JV, an unincorporated collaboration set up to focus on battery minerals, was formalised on December 20 last year, when Liatam met the required earn-in expenditure.

As the owner of the included tenements and manager of the joint venture, Liatam plans to invest around $6 million in 2024 to advance lithium exploration at Quartz Hill.

Successful exploration

Exploration work thus far has extended known lithium mineralisation at the Lepidolite Fields LCT pegmatite swarm target.

Key results from surface sampling by Liatam include:

- 2.71% lithium dioxide (Li2O), and 828 parts per million (ppm) caesium monoxide (Cs2O);

- 2.37% Li2O, 303 ppm Ta2O5 and 883 ppm Cs2O;

- 2.14% Li2O, 615 ppm Ta2O5 and 1,195 ppm Cs2O; and

- 1.98% Li2O, 277 ppm Ta2O5 and 882 ppm Cs2O.

Drilling next

A drilling campaign is planned for the second half of 2024, aiming to test the 6-kilometre-long and 0.8-kilometre-wide Lepidolite Fields LCT pegmatite swarm.

This program will involve about 9,000 metres of reverse circulation (RC) drilling.

What’s more, a second LCT pegmatite swarm has been identified at Quartz Hill West and The Gap, with impressive surface results such as:

- 2.45% Li2O and 589 ppm Cs2O;

- 2.23% Li2O, and 1,290 ppm Cs2O; and

- 1.22% Li2O, 181 ppm Ta2O5, and 780 ppm Cs2O.

Novo and Liatam are planning various exploration activities in 2024 and beyond, including helicopter-supported heritage and ethnographic surveys in the second half of the year, contingent on weather and heritage considerations.

Alongside this, further reconnaissance mapping and surface sampling will address gaps from the 2023 exploration campaign, focusing on areas east of Lepidolite Fields where pegmatite swarms have been identified in geophysical data sets.

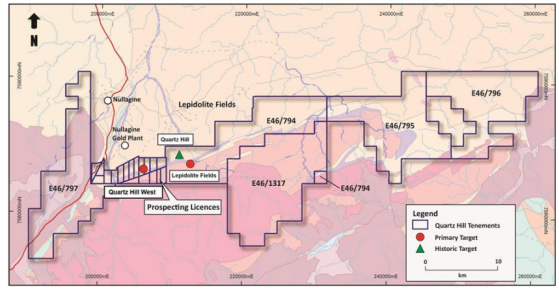

Quartz Hill Joint Venture tenement map identifying primary LCT pegmatite targets.

A regional soil sampling program will help identify buried pegmatite swarms in poorly outcropped areas at Cadjuput Creek, Quartz Hill West, Lepidolite Fields and other regional targets.

Following the completion of heritage surveys and geochemical targeting, RC drilling is scheduled to test high-priority targets within Lepidolite Fields.

Exciting potential

“Novo is pleased that Liatam continues to progress the Quartz Hill Joint Venture with ~A$6 million to be spent on exploration during 2024 and that plans are underway to identify further lithium-bearing pegmatites at Quartz Hill,” executive co-chair and acting CEO Mike Spreadborough said.

“Activities to date have validated the exciting potential of the area and we look forward to providing updates as exploration continues.

“Novo’s ongoing exposure to future exploration and discovery success on battery metals projects via JV agreements is a core component of delivering long-term shareholder value.”

About Novo

Novo is an Australian-based gold explorer focusing on discovering standalone gold projects with more than one million ounces of development potential.

The company holds a significant land package in the Pilbara region of Western Australia and the Belltopper project in Victoria, Australia.

Novo's flagship project is the Egina Gold Camp, where De Grey is farming in for a 50% interest through a A$25 million exploration expenditure within four years.

Read more on Proactive Investors AU