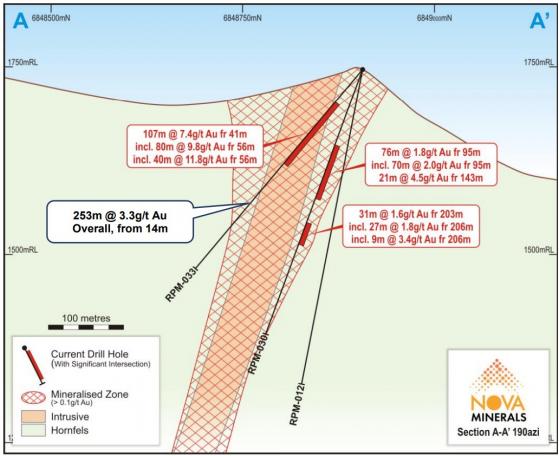

Nova Minerals Ltd (ASX:NVA, OTCQB:NVAAF) has revealed the potential for a second mining centre in the southern area of its flagship Estelle Gold Project in Alaska as the foot print at its high-grade RPM project continues to grow following the intersection of further high-grade gold hits at its RPM North Deposit and maiden results from RPM South showing the discovery of a 2nd larger minerialised zone.

The results are from a combination of infill and extensional drilling and highlight the high-grade nature of the near-surface mineralisation.

Significant step-out results include:

RPM-033

- 107m (metres) @ 7.4 g/t Au (gold) from 41m including;

- 80m @ 9.8 g/t Au from 56m; and

- 40m @ 11.8 g/t Au from 56m.

Video commentary on the RPM results and discussion about the potential for a southern area mining centre can be found on Nova's website here.

Nova CEO Christopher Gerteisen said: “I am pleased to report more major high‐ grade broad intercepts from our drilling at RPM.

“These new results have something for everyone with further high-grade intersections confirming the continuity of the bonanza zone at RPM North, and expansion of the total resource area with RPM South and a second mineralized intrusive now defined.

“While the initial RPM South holes replicate the early discovery results which we saw at RPM North in hole SE12-008, which led us to the bonanza blow out zone, importantly the 2022 drilling has now also confirmed a second much thicker mineralized intrusive which connects the RPM North and RPM South zones, demonstrating a genetic link between the two areas.

“With over 600m of strike length between the two zones, and similar geological observations to RPM North, the deposit remains wide open, with the search now on for more super high-grade bonanza zones providing further upside resource potential as we move forward.

RPM drilling summary

The 2022 infill and extensional resource drilling programs at both RPM North and RPM South are complete and pending an upgraded resource estimate and oriented core structural studies.

RPM North

- 76m @ 1.8 g/t Au from 95m including;

- 70m @ 2.0 g/t Au from 95m; and

- 21m @ 4.5 g/t Au from 143

RPM North - continuity of mineralisation.

RPM South

- 116 m @ 0.9 g/t Au from 8m including;

- 94m @ 1.0 g/t Au from 24m; and

- 15m @ 2.3 g/t Au from 94m.

RPM South - broad zone of mineralisation from surface.

The drilling also continues to provide high-quality geological data that is being collated and interpreted to provide greater deposit knowledge.

The nature and geometry of the intrusive units, and interplay with structures, are key to controls on gold mineralisation.

These geological and interpretative insights are invaluable in developing further targets for the systematic exploration programs within the RPM area, as well as across the greater Estelle Gold Trend.

Potential Southern Area mining Centre

The significant scope for major resource development at RPM, and possibly another deposit in the Train and Shoeshine areas as well (subject to drilling to commence in 2023), has now given the company optionality to investigate the case for potentially developing two standalone mining operations along the Estelle Gold Trend – A northern mining centre around the Korbel Area and a southern mining centre around the RPM/Train Areas (Figure 1).

Figure 1. Unlocking the opportunity to establish two major mining centres within the Estelle Gold Trend.

Upon the completion of Phase 2 Scoping Study, PFS level trade-off studies will be used to investigate the possibility of establishing an initial smaller standalone southern area mining centre around RPM, for the initial years, with a larger northern area mining centre around Korbel to be commissioned in later years, as outlined in the previously released Phase 1 Scoping Study.

Gerteisen added: “Excitingly, we have now also started to investigate the possibly of developing a second smaller mining centre in the southern part of the Estelle Gold Trend, which will be tested as part of our PFS trade off studies, upon the completion of the Phase 2 Scoping Study.

“With resource definition and extensional drilling at RPM expected to increase both the confidence level of the resource and extend the mineralisation, an updated Mineral Resource Estimate (MRE) is now being completed, with the inclusion of the high-grade RPM ore in the production schedule expected to have a significant positive impact on key economic metrics in the Phase 2 Scoping Study, now well underway.

“With long-term opportunity and the prospect of multiple mining centres across the single project, we continue on our path to becoming a world class, global gold producer.”

Read more on Proactive Investors AU