Nova Minerals Ltd (ASX:NVA, NASDAQ:NVA) has launched an underwritten public offering of American Depository Shares (ADS) to raise up to US$2.15 million before costs.

The funding will go toward resource and field exploration programs for gold, antimony, and other critical minerals across NVA’s portfolio. It will also help accelerate optimisation studies for the RPM starter mine pre-feasibility study (PFS), a near-term cash generation opportunity.

The raising was completed in the US following feedback from bankers and potential US investors that they wanted more liquidity in Nova’s NASDAQ listed ADS.

The company is offering 430,000 ADS at a ratio of 1 to 60 to ordinary shares – the equivalent of 25.8 million ordinary ASX shares – for a public price of US$5.00 per ADS.

Nova has also offered underwriters a 45-day option to purchase additional ADS up to 43,000 to cover over-allotments, if any.

NVA’s public offering will close on September 15, US eastern standard time, with ThinkEquity acting as the sole book-running manager.

Gold prices at all-time highs

Nova has already defined a 9.9-million-ounce gold resource across four gold deposits at Estelle, at a time when global gold prices are setting consecutive new all-time highs – gold is hovering at US$2,652 per ounce at present.

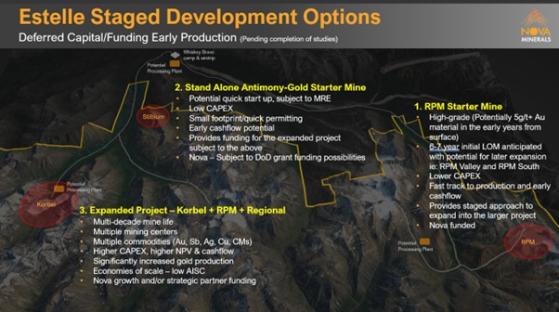

NVA is developing the Estelle Project with optionality in mind, keeping multiple pathways for initial project sizing and scale open.

The ongoing PFS for Estelle has been designed to assess alternate strategies to achieve production with a scalable operation, with market conditions and strategic partners in mind.

Read: Nova Minerals considers two production pathways for Estelle Gold Project ahead of PFS

The options currently under consideration are:

Antimony potential at Stibium

With China announcing export restrictions on antimony, Nova is also developing the Stibium Antimony-Gold Prospect. NVA is investigating the Stibium prospect as an additional small scale, stand-alone, quick start up cash flow opportunity, with potential US Department of Defense (DoD) support.

The company recently began bulk testing of antimony mineralisation at Stibium, the results from which will inform a potential process flow sheet and plant design.

Read: Nova Minerals begins bulk testing at Estelle Antimony District in Alaska

Antimony is a highly sought-after critical mineral vital to defence and energy applications.

Supply has been impacted by a recent export restriction from China, prompting governments to secure new sources to meet demand.

Nova has submitted a proposal to the US DoD for grant funding, aimed at accelerating production, and believes the timing is right for the grant to be successful given recent supply constraints – China accounted for 48% of antimony production in 2023.

Read more on Proactive Investors AU