Nova Minerals Ltd (ASX:NVA, OTCQB:NVAAF) has revealed more high-grade gold results from its RPM deposit, this time from the new broad zone at RPM Valley, within the company's flagship Estelle Gold Project in Alaska.

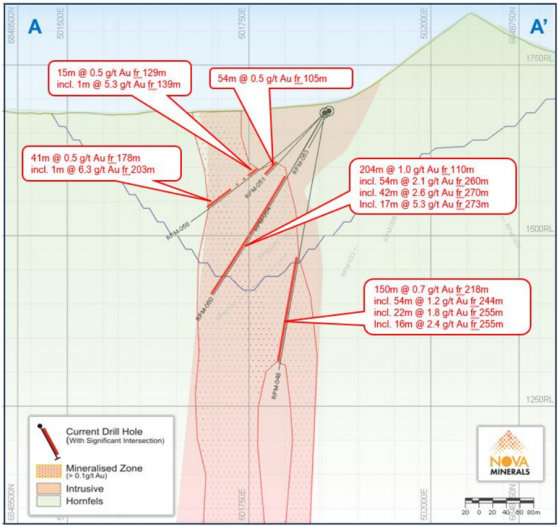

A total of six holes were drilled into RPM Valley in 2023 designed to follow up and confirm on previous drilling which intersected a new mineralized zone in the valley with results including:

RPM-048

- 54m (metres) @ 1.2 g/t Au (gold) from 244m including;

- 22m @ 1.8 g/t Au from 255m

- 16m @ 2.4 g/t Au from 255m

(RPM-048 returned an average grade of 0.7 g/t Au over 150m from 218m at 0.1 g/t cutoff)

RPM-060

- 54m @ 2.1 g/t Au from 260m including;

- 42m @ 2.6 g/t Au from 270m

- 17m @ 5.3 g/t Au from 273m

(RPM-060 returned an average grade of 1.0 g/t Au over 204m from 110m at 0.1 g/t cutoff)

RPM-063

- 9m @ 3.1 g/t Au from 83m

- 70m @ 1.1 g/t Au from 205m

(RPM-063 returned an average grade of 0.5 g/t Au over 78m from 68m and an average grade of 0.9 g/t Au over 84m from 191m, at 0.1 g/t cutoff)

The drill results from the overall 2023 drilling program at RPM clearly demonstrate that RPM is a large system that continues to grow with the deposit remaining wide open in several directions where the potential remains for continuity linking the mineralised zones and to discover further very high-grade pods similar to RPM North.

The planned 2024 resource drilling program will prioritize RPM to continue to realise this upside potential.

RPM Valley Section A-A’_070azi showing continuity of mineralisation.

Nova CEO Christopher Gerteisen said: “These new drilling results confirm an extensive mineralized zone within RPM Valley which presents further significant resource upside potential at RPM which will be followed up as a high priority target with infill and step out drilling in 2024 and beyond.

“RPM continues to illustrate the unique opportunity that we have at the Estelle Gold Project, and we will now look to grow on the successes achieved with outstanding potential for resource and exploration upside.

“The latest results will be incorporated into an updated resource as part of the PFS study which is currently underway.”

3D Vrify model view looking at RPM North and RPM Valley to the East with the scoping study open pit shell. The arrows show the deposit remains wide open in many directions. New 2023 drill results have black line drill traces.

Gerteisen added: “Based on the multi-element assays from drilling to date, the company looks to include silver in resource estimates which is expected to provide significant bi-product credits at RPM and Korbel.

“We are fast progressing through the formal strategic review process across the Estelle Gold Project with optimization work ongoing, reducing capex and setting and fastest path to commercial production to minimize shareholder dilution.

“While key objectives of the strategic review remain a work-in progress, we will keep our shareholders updated as relevant studies are completed to unlock further value from the Estelle Gold Project.”

Next steps

With the success at RPM to date, and the upside potential and its close proximity to the Train area, RPM is starting to shape up to potentially be its own mining centre, in addition to the bulk mining centre proposed at Korbel.

PFS level studies are ongoing with METS Engineering conducting metallurgical test work to optimize the process flowsheet and Rough Stock Mining performing mining studies including geotechnical work that has confirmed a minimum pit slope angle of 50 degrees with the potential for further steepening under review, all of which is expected to provide additional economic upside.

Further results from the extensive soil and rock chip samples taken from across the project area in 2023 will be reported by area once received and processed.

Read more on Proactive Investors AU