Nova Minerals Ltd (ASX:NVA, OTCQB:NVAAF) is gearing up for its 2023 field program after a robust phase 2 scoping study, which confirmed the potential for a commercially viable mining operation at the Estelle Gold Project in Alaska.

The scoping study demonstrated all-in-sustaining costs (AISC) of US$510 per ounce for the first year and US$1,149 per ounce over the project's life.

Read: Nova Minerals delivers robust economic metrics with promising upside in Estelle Gold Project scoping study.

To kickstart the 2023 drilling season, helicopters, pad building crews and geologists have already mobilised to the project site.

The study has provided strong indications of a commercially viable mining operation at Estelle, showcasing impressive financial and mining metrics.

With preparations in full swing, the company is focused on increasing the mill feed grade and optimising the process flowsheet to further enhance project economics.

Major milestone

Nova CEO Christopher Gerteisen said: “With the completion of the Phase 2 Scoping Study, which was a major milestone for the company and provided some clear goals going forward, particularly in relation to increasing the LOM mill feed grade and optimizing the process flowsheet, we are excited to be ramping up the activity on site as we prepare for our upcoming 2023 drill program.

“This year our drill program and test work is aimed at honing in on walk-up targets to rapidly increase the mill feed grade and optimize metallurgical studies further for higher recoveries as the study has shown that any improvements in these areas have the greatest positive impact to the bottom line.

“We are confident that the combination of economic and technical strengths which come from having a large, bulk tonnage project in a Tier-1 location, will drive shareholder value as we continue to unlock the Estelle Gold Project on our path towards production.”

Scoping study highlights

Nova’s phase 2 scoping study, which was based on a mining scenario up-fronting the higher grade, confirmed the potential for a commercially robust mining operation at the Estelle Gold Project.

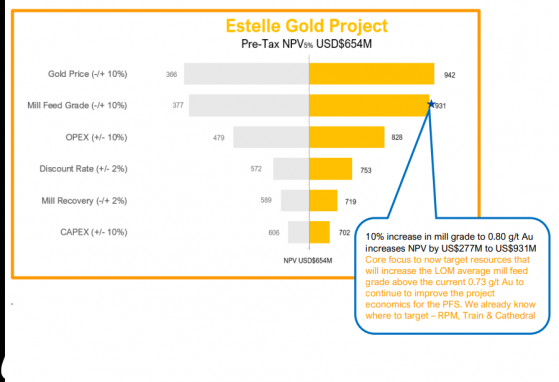

On top of the impressive AISC and a net present value (NPV) of US$654 million, the estimated pre-production capital for a central processing plant and infrastructure is US$385 million with a very quick 11-month payback period

The study provides great exploration upside and a solid platform for growth and has identified clear opportunities for immediate improvement of metallurgical test work that would add to the bottom line.

The study's sensitivity analysis highlighted the substantial impact of increasing the average mill feed grade above the current 0.73 g/t gold.

Even a modest 10% increase to 0.8 g/t gold resulted in a US$277 million rise in net present value (NPV).

With this insight, Nova Minerals aims to concentrate its efforts on drilling walk-up targets to maximise the mill feed grade and optimise metallurgical studies for higher recoveries.

Preparation work

In preparation for the upcoming drilling program, the Whiskey Bravo airstrip has been cleared, fuel and other supplies have been brought in, and helicopters and contractors have also arrived on site and have started moving materials and other supplies for pad building up to the proposed drilling area.

Three drills are also currently winterised and awaiting the completion of pads before being flown up to their initial target locations to commence drilling, subject to weather conditions.

Forward plan

Nova plans to drill about 15,000 metres this year, utilising an average of three diamond rigs with PFS stage drilling focusing on both increasing the drill density of the resource and extensional drilling to further grow the resource, as outlined in the 2023 drill program.

The core aim is to drill around 12,000 metres at the RPM area and expand the surface high-grade resource around the existing deposits at both RPM North and RPM South.

In addition, drills will also target the 600-metre-high priority continuous mineralised area linking RPM North to RPM South which intersected a second large mineralised intrusive in the lower part of holes RPM-037 and 3,000 metres of maiden drilling in the Train area.

Drilling at the Train area will target the RPM-style mineralisation that was discovered there with the aim to define a third gold resource in the area.

Read more on Proactive Investors AU