Nova Minerals Ltd (ASX:NVA, NASDAQ:NVA) has freed up around $2 million to accelerate the RPM gold deposit through a variation to the convertible note facility with its largest institutional holder, Nebari Gold Fund 1, LP.

This progresses the RPM early start up option towards a pre-feasibility study (PFS) for delivery in 2025.

Nova will conduct internal optimisation studies aimed to investigate how it can generate as much early cashflow as possible to organically fund its expansion plans across the Estelle project.

This head start gives the company the ability to continue its advanced discussions with the US Dept. of Defense (DoD) in relation to potentially establishing a starter antimony operation at Stibium in parallel.

The company also has the option to extend the convertible facility with Nebari by another 12 months to November 2026.

Secondary offering to fund resource exploration

Nova also today filed a registration statement with the US Securities and Exchange Commission (SEC) for a secondary public offering of its American Depositary Shares (ADS) – a key step in the company’s expansion plans.

Each ADS will represent 60 of Nova's ordinary shares. The offering price is based on an assumed price of US$6.53 per ADS, though the final pricing and number of shares are yet to be determined.

ThinkEquity will act as the sole book-running manager for the offering, which is subject to market conditions and SEC approval.

The proceeds from the offering are intended to fund resource and exploration programs, including additional drilling, feasibility studies and general working capital.

Upon completion, Nova’s ordinary shares will remain listed on the Australian Securities Exchange (ASX), with its ADSs and public warrants continuing to trade on the Nasdaq Capital Market.

This move comes as part of the company's broader strategy to enhance its presence in the US market while continuing its operations in Australia and Europe.

Optionality for project development

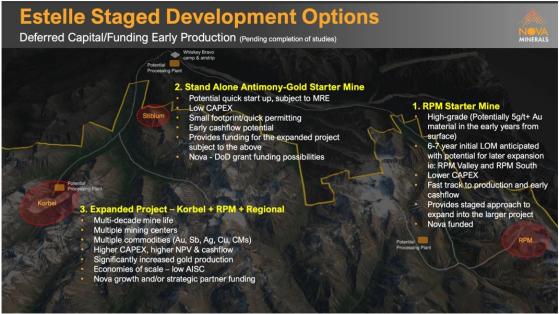

With an already defined multi-million ounce gold resource across 4 deposits, the Estelle Project has development optionality in terms of initial project size and scale.

The PFS currently underway involves considering a strategy to achieve production with a scalable operation, subject to market conditions and strategic partners, by:

With China announcing export restrictions on antimony, the Stibium Antimony-Gold Prospect is being advanced and investigated as an additional small scale, stand-alone, quick start up cash flow opportunity, with potential US Dept. of Defense (DoD) support.

Nova CEO Christopher Gerteisen said: “It is a pleasure to work with Nebari, our largest institutional shareholder and note holder, which has shown strong support and indicated an unwavering commitment towards advancing the project through to production.

“We are certainly both aligned with the current fast track RPM PFS completion strategy aimed at achieving production as soon as possible.

Freed up to deliver

“Working together we have now freed up more than US$1.3 million in cash to strengthen our financial position to facilitate this effort to deliver a lower capex, high margin, scale-able project focused initially on development of the RPM gold deposit to generate free cash flow as soon as possible to enable future growth across the larger Estelle Project area.

“With the continued support of Nebari, and all of our shareholders, we will work together for the ongoing progress and success of the company as we continue to advance on our path towards commercial production.”

Nebari senior managing director Roderik van Losenoord adds: “We are very pleased to be supporting Nova and its Estelle Project, as the company explores routes to develop RPM.

“Support and partnership is what the Nebari-lending relationship with our borrowers is all about.”

Read more on Proactive Investors AU