NickelSearch Ltd (ASX:NIS) has traded up to 115% higher after observing massive sulphide mineralisation in the upper mineralised horizon (UMH) and lower mineralised horizon (LMH) in two diamond drill holes at Sexton Prospect within the Carlingup Nickel Sulphide Project in Western Australia.

Both diamond drill holes at Sexton returned visual sulphides in the UMH and LMH, with both horizons intersected at shallower depths than expected in the second drill hole.

Diamond drill hole 23NDD030 intersected massive sulphides in the same horizon, which demonstrates the nickel mineralisation continues 60 metres further along strike, extending the total strike length to 250 metres.

Looking ahead, assays from the two diamond holes are expected in early August and NickelSearch hopes that these will confirm the preliminary observations.

Follow-up downhole electromagnetic (DHEM) surveys are now planned for these diamond holes to further test the extent of the sulphide mineralisation, which exhibits a strong DHEM anomaly response.

The markets welcomed the news with shares trading as high as $0.12 in early trading, up 115% from the previous close.

Highly prospective targets

NickelSearch managing director Nicole Duncan said: “We are delighted to report that we have once again intersected visual sulphides, including massive sulphide mineralisation, in our diamond drilling program at Sexton, one of our highly prospective targets at Carlingup.

“The hole confirmed the presence of nickel sulphide mineralisation sitting in a structure located at relatively shallow depths of ~145 metres and starting quite close to surface at ~40 metres, which is particularly pleasing.

“This mineralisation was intersected shallower than anticipated and our planned DHEM surveys in the DD will allow for more constrained models and show where the intersections are in respect of the new models. We eagerly look forward to assay results in the coming weeks.”

Drill program

The drill program at Sexton targeted two distinct bodies of mineralisation encountered in earlier RC drilling and corroborated by DHEM surveys.

The primary aim for the drilling was to identify the massive sulphides associated with the LMH, with the holes also designed to test the potential for further nickel sulphide mineralisation within the UMH.

To date, the drilling has shown there are multiple horizons of nickeliferous sulphide, shallowly plunging to the southeast, with the up- and down-dip extents undefined and open along strike.

Logging results

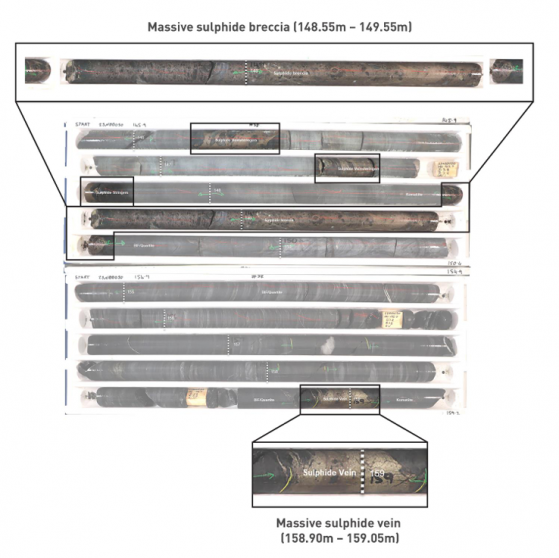

In the first diamond hole at Sexton (23NRD028), the mineralisation is spread over nine metres and includes a number of intervals of various thicknesses of net textured/matrix to semi-massive/ massive sulphides, predominantly pyrrhotite +/- pentlandite and pyrite, with minor chalcopyrite.

In the second diamond hole (23NDD030), the mineralisation intersected is similar to that of 23NRD028, with several sulphide intervals at the ultramafic and sediment contacts.

The main sulphide morphologies included semi-massive/massive breccias and veins, predominately pyrrhotite +/- pentlandite and pyrite, with minor chalcopyrite locally.

Forward plan

The next steps at Sexton include:

- DHEM surveys will be performed on the two diamond holes at Sexton as soon as possible;

- Assays expected in about six weeks;

- Drilling is underway at B1 Prospect, where May 2023 intersections confirmed and extended the area of known historical nickel sulphide intercepts with sulphide-bearing komatiites and cumulate ultramafics logged.

Read more on Proactive Investors AU