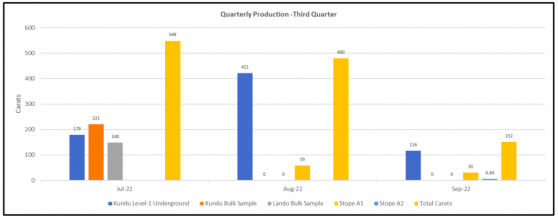

Newfield Resources Ltd (ASX:NWF) yielded a total of 1,180 carats from processing 504 tonnes of underground and surface bulk samples from its Tongo Diamond Project in Sierra Leone during the September quarter, achieving a combined process grade of 2.34 carats per tonne at a more than 1.2 millimetre cut-off.

The surface bulk samples yielded 221 carats from the Kundu kimberlite and 148 carats from Lando, the Perth-based diamond producer said, noting that the diamond quality remained consistent with previously announced production.

Looking ahead, underground production carats will increase next quarter as the first and second Level-1 mine stopes are drawn and processed, Newfield said in its quarterly report.

Quarterly carats produced July to September 2022.

Mine development

The company has carried out a total of 1,831 metres of underground development at the Tongo mine after completing 317 metres during the September quarter.

Work has focused on advancing the Kundu rock and reef drives to provide access to the second and third stope faces on the Kundu A ore body segment.

The first Level-1 production stope has advanced some 26.3 metres during the quarter to a total of 45.4 metres to date, and has reached the safety pillar, marking the completion of the stope.

As well, the second Level-1 production stope was established and has advanced away from the safety pillar by some 6 metres at the end of the quarter.

Bulk sampling

A total of 2,699 carats were recovered from bulk sampling of the Kundu and Lando kimberlites.

The Kundu sample yielded a total of 1,062 carats from a surveyed in-situ kimberlite tonnage of 474 tonnes, giving a more than 1.2 millimetre kimberlite grade of 2.34 carats per tonne,

The Lando sample yielded a total of 1,637 carats from a kimberlite tonnage of 762 tonnes, giving a more than 1.2 millimetre grade of 2.15 carats per tonne.

Workers' safety

There were zero lost time injuries (LTI) recorded during the period and the financial year to date, which means the company logged 130 LTI-free days as at the end of the quarter.

The life of mine Loss Time Injury Frequency Rate (LTIFR) has improved to 0.48 from 0.53 at the end of the last quarter, based on per 200,000 hours worked.

The National Minerals Agency completed its site visit to look into the fatality reported in the last quarter and have authorised the mine to resume full operations.

Furthermore, the company has completed all processes regarding the full and final compensation settlement with the bereaved family.

Looking forward

Newfield will continue with Level-1 stope mining, and the development of the Kundu and Lando declines.

In addition, the development towards the Kundu B and C kimberlite segments to the west of the ore body are expected to resume. The objective is to establish return airway developments on the two segments.

The board of directors will continue to assess the company’s funding strategy to progress the development of the Tongo diamond mine into production.

The full quarterly update can be read here.

Read more on Proactive Investors AU