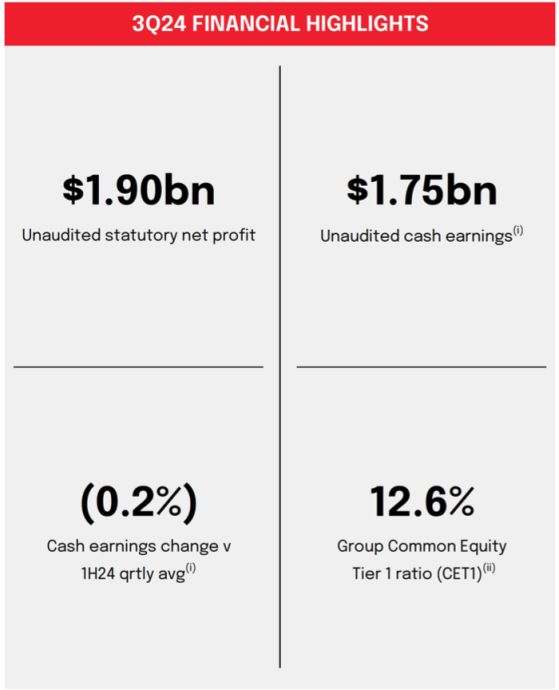

National Australia Bank Ltd has cautioned about worsening loan losses, recording a A$118 million impairment charge, alongside a reduced A$1.75 billion cash profit for its third quarter.

The bank's third-quarter earnings fell by 7.8%, down from the A$1.9 billion cash profit reported in the same period last year, disappointing analysts.

NAB informed its investors that while lending had grown during the period, asset quality across its loan book was deteriorating.

This development follows NAB’s earlier credit impairment charge of A$363 million booked in the first half of the year.

NAB reported that the recent increase in impaired assets indicated further deterioration across the group but noted that individually assessed charges remained at low levels. The bank’s collective provisions rose by 4 basis points to 1.51% of gross loans.

Non-performing exposures to gross loans increased by 11 basis points from March 2024 to 1.31%, with NAB noting that “this mainly reflects continued broad-based deterioration in the Business & Private Banking business lending portfolio, combined with higher arrears for the Australian mortgage portfolio.”

"Our 3Q24 result reflects a more stable operating environment and benefits from the consistent execution of our strategy,” NAB CEO Andrew Irvine stated in a report to shareholders.

“Lending balances rose 1% over the June quarter, supported by 3% growth in Australian SME business lending as we continue to prioritise growth in our SME franchise. In Australian home lending, our growth was sub-system at 1%.

“Balancing returns and growth in this dynamic market will remain important. Deposit growth is an ongoing focus and was 1% across Business & Private Banking and Personal Banking over 3Q24. We have delivered further efficiency benefits this quarter, helping us manage costs while investing for long-term sustainable growth. We continue to target productivity savings of approximately $400 million in FY24 and for cost growth in FY24 to be lower than FY23.”

Lending rises but underlying profits decline

NAB’s overall lending rose by 1% over the June quarter, driven by a 3% increase in small business lending.

Irvine noted that NAB aimed to balance returns and growth “in this dynamic market.” Despite this, the bank reported a 2% decline in underlying profits for the period.

On a statutory basis, NAB delivered an unaudited A$1.9 billion profit for the quarter. This resulted in a 1% decline in revenues across the group compared to the first half, with only NAB’s Markets and Treasury business experiencing an earnings increase.

NAB’s net interest margin remained stable, with small reductions in lending competition and deposit mix offset by the benefits of a higher rate environment.

Expenses increased by 1% in the quarter compared to the bank’s first-half result, driven by higher wages, partially offset by productivity gains.

Irvine signalled further efforts to reduce costs and “complexity across NAB.”

“The economic environment, including persistent inflationary pressures, is challenging for our customers and we are here to help them,” he stated.

“While most customers are proving resilient, not unexpectedly we have seen asset quality deteriorate further in 3Q24. It is essential we keep our customers and our bank safe. Liquidity and collective provision coverage are healthy. Capital remained strong over the quarter supporting the continuation of our on-market share buy-back.

“Our strategy has served us well over recent years. As we build on this progress, our strategic priorities will evolve including an increased focus on delivering better service to customers and removing complexity across NAB. But there will be no change to our disciplined approach to accountability and execution. We remain well placed to manage our business for the long term and deliver sustainable growth and returns for shareholders."

NAB informed investors that its common equity tier 1 ratio — a key measure of the bank’s financial health — was 12.6%, above NAB’s 11.5% target.

This comes despite NAB repaying A$18 billion in maturing Term Funding Facility loans over the June quarter and raising A$35 billion over the 10 months to the end of July.

NAB has also invested A$1.5 billion of a total A$3 billion buyback into on-market purchases of its shares.

The bank expects to complete the remainder of the buyback by May next year.

Read more on Proactive Investors AU