Moho Resources Ltd (ASX:MOH) welcomes the results of a preliminary evaluation by consultant geochemist Richard Carver of lithium and associated element assay data of soils and stream sediments at Moho’s 100%-owned tenements at its Burracoppin Project in WA.

The Burracoppin Project, also prospective for gold and ionic clay rare earth elements, is in the WA Wheatbelt and about 15 kilometres northeast of the regional town of Merredin and 22 kilometres west of the Edna May gold mine operated by Ramelius Resources.

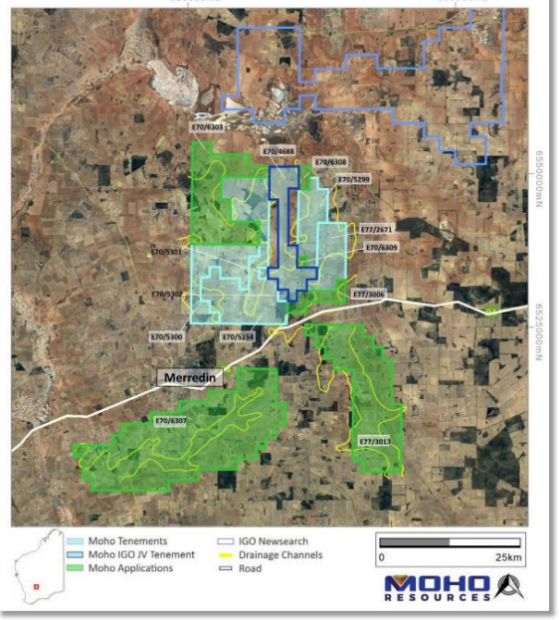

Moho’s Burracoppin project in Western Australia.

Targeting LCT

The objective of the evaluation was to determine the potential for LCT (lithium, caesium, tantalum) pegmatites within Moho’s tenements.

Preliminary geochemical review identified anomalous lithium in soils and streams within Moho’s 100%-owned tenements at Burracoppin.

Lithium anomalies are reinforced by soils and streams anomalous in caesium, rubidium, beryllium and niobium, which are present at many LCT pegmatites.

The strong spatial relationship between lithium and niobium in the soils has helped the company pick out new target areas potentially anomalous for lithium and these are yet to be tested.

Next steps

The company plans to conduct field mapping, further soil sampling and geochemical analysis over areas with high lithium and REE prospectivity to define drill targets. It will then hit the lithium and REE targets with aircore and/or reverse circulation (RC) drills.

“The geochemical evaluation of the soil and stream surveys has established significant lithium and REE prospectivity for the company to follow up at the Burracoppin project,” said managing director Ralph Winter.

“Moho’s exploration strategy is opening up new avenues for greater value creation for our shareholders, with the forecast demand for critical minerals expected to be strong for many years to come.”

New exploration licences

Moho owns a 70% interest in E70/4688 and a 100% interest in granted exploration tenements E70/5154, E70/5299 to 5302 and E77/2671, which cover 454 square kilometres.

New exploration licence applications E70/6303, E70/6307- 6309 and E77/3013 covering roughly 1,300 square kilometres were lodged in October 2022 for their rare earth element prospectivity.

Moho and IGO Ltd formed an unincorporated joint venture for the purpose of exploring and, if warranted, developing and mining on E70/4688.

IGO’s 30% interest will be free carried until completion of a pre-feasibility study, at which time IGO may elect to contribute pro-rata to ongoing work or convert its 30% interest to a 10% free carried interest.

Moho has also undertaken substantial exploration around E70/4688 and expanded the tenure of the Burracoppin Project.

Read more on Proactive Investors AU