Miramar Resources Ltd has kicked off drilling at its highly prospective gold projects in world-class locations and is progressing various other projects through permitting and or tenement grant.

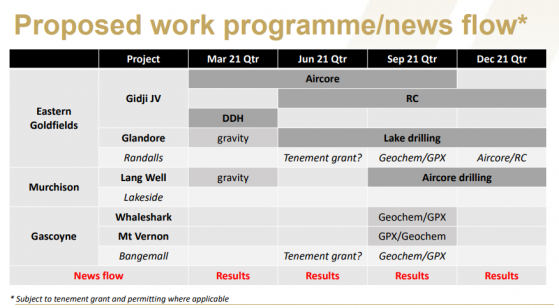

The Western Australian-focused company is set for a busy 2021 with its pipeline of targets and proposed work programs, which includes increasing its landholding in an emerging nickel-copper-platinum group element (PGE) province.

Its portfolio of exploration projects has high potential for gold discoveries that are within trucking distance of existing operations.

The company is well funded to carry out its proposed activities, having raised $8 million in a heavily oversubscribed IPO, which saw the company’s shares list on the ASX in October 2020.

The company’s portfolio of gold exploration projects include:

- Eastern Goldfields (Gidji, Glandore, Randalls)

- Murchison (Lang Well, Lakeside, Garden Gully)

The company’s initial focus will be on exploring the Gidji and Glandore projects, near the gold mining centre of Kalgoorlie-Boulder in Western Australia’s Eastern Goldfields region.

Eastern Goldfields Projects

Miramar has three highly prospective but underexplored gold projects near Kalgoorlie – its 80%-owned Gidji joint venture, Glandore and Randalls.

The Gidji venture is a strategic landholding 15 kilometres north of Kalgoorlie while Glandore has a 2 kilometres-long zone of underexplored gold mineralisation and Randalls is a folded banded iron-formation (BIF) adjacent to the Silver Lake Gold operations.

All are well-positioned to existing mining and processing operations and have excellent access via the Goldfields Highway.

Despite its prime location, this area has been poorly explored.

Its maiden aircore drill program, which completed in December 2020 at Gidji identified several new targets, including the Marylebone target, within the Boorara Shear Zone.

Multiple new targets were highlighted, including:

- Marylebone - high-grade gold in quartz vein (2 metres at 7.7 g/t gold);

- 8-Mile – possible extension to 314,000 ounces Runway extension;

- New target parallel to Runway; and

- Railway – west of highway.

The next phase of drilling will include:

- Infill drilling at 200 x 50 metres spacing to follow-up significant results from the phase-I campaign; and

- Drilling of two diamond holes to test the potential for a northern extension to the neighbouring 314,000-ounce Runway deposit.

Miramar executive chairman Allan Kelly said: “Our first drilling program confirmed our hypothesis regarding the prospectivity of the Gidji Project and identified several new targets, including the potential for a new discovery at Marylebone.

While waiting for the follow-up drilling program to begin, the company has been busy working up historical geophysical data, which highlighted several important geological features which will assist in refining drill targets within both the granted and pending areas of the project.

The Boorara Shear Zone demonstrates an obvious linear gravity high as a result of the relatively dense mafic and ultramafic rocks present within this important regional structure.

A discrete, higher amplitude gravity anomaly is observed within the interpreted dilational jog at the southeast end of the Boorara Shear Zone.

This is a high priority target and will be drill tested once the relevant tenements are granted.

Railway, 8-Mile and the new target all appear to be associated with lower magnitude gravity anomalies within sediments of the Black Flag Group, which may represent previously unrecognised mafic intermediate porphyry units, similar to that which hosts the bulk of the gold mineralisation at Runway.

The Lake and Claypan targets, within an application pending grant, are both on major regional structures observed in the newly obtained gravity and corresponding magnetic data.

The next steps for Gidji include:

➢ Infill aircore drilling at Marylebone, 8-Mile, Railway and new target

➢ Diamond drilling at 8-Mile

➢ Examine various geophysical methods to assist in drill targeting

➢ Progress remaining tenements to grant

Glandore plans

Miramar received heritage approvals on February 21, 2021, which allow for the commencement of exploration work on the 100%-owned Glandore Project, around 40 kilometres east of Kalgoorlie.

The company has also acquired historical gravity data for the project which, when combined with the existing magnetic data, highlights a number of important geological features and will be used to assist in planning the first drill programs.

A survey to infill the historical gravity data within the south-western part of the project and to collect first pass gravity data over the exploration licence is planned, with the aim of testing for repetition of the granite dome and the potential for gold mineralisation similar to the deposits further south.

Randalls

Randalls has high-grade rock chips along strike at Pryde and Logan prospects, with minimal sampling/drilling within the Miramar tenement.

It has excellent access and is within trucking distance of several mills.

Surface geochem/drilling has been planned following the tenement grant.

Murchison Projects

The company has three projects in the Murchison covering under-explored greenstone belts: Lang Well, Lakeside and Garden Gully - all well located near existing gold operations and processing facilities.

The Lang Well is an underexplored greenstone belt between Deflector, Golden Grove and Rothsay with historic chips up to 16 g/t gold and multiple large auger gold anomalies.

It is very poorly explored with minimal previous drilling and no gold exploration since 2010.

The company has completed the infill regional gravity data to refine the extent of greenstones.

It is planning first pass aircore drilling of auger anomalies in the second half of 2021 and has applied for funding under the current Exploration Incentive Scheme (EIS) round.

Gascoyne Projects

The under-explored Capricorn Orogen region is highly prospective for gold, copper and nickel-copper-PGE.

Miramar has two projects in this region: Whaleshark and Bangemall.

Whaleshark is prospective for BIF-hosted gold and iron oxide-copper-gold (IOCG) and work planned include soil sampling, infill gravity and ground/airborne EM.

In early 2021, Miramar received the grant of the first of several exploration licence applications in the Bangemall region, which are prospective for nickel-copper-PGE mineralisation.

The company is obtaining quotes for an airborne EM survey to cover the project at a more suitable line spacing.