Miramar Resources Ltd (ASX:M2R) continues to progress exploration activities at its large 100%-owned Bangemall Project in Western Australia as it works towards a maiden drill program and seeks to open up Bangemall region as a new nickel-copper province.

The company is exploring for Norilsk-style nickel, copper and platinum group element (PGE) mineralisation at the project in the Gascoyne region.

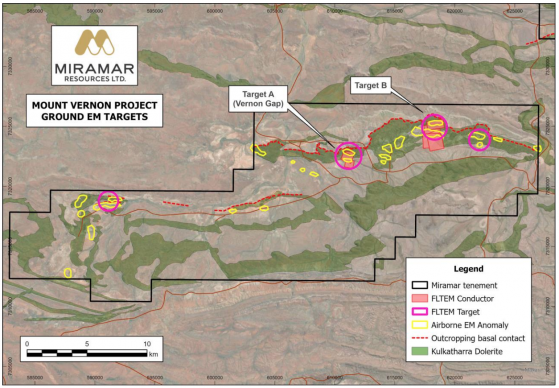

After a short break due to extreme weather throughout the region, Miramar has recommenced a fixed loop electromagnetic (FLTEM) survey within the Mount Vernon project areas.

So far, the FLTEM survey has identified multiple late-time conductors at the first two targets tested to date. Modelling of the data indicates south-dipping conductive plates near the base of the dolerite sill where nickel-copper sulphides may have accumulated.

The FLTEM survey will test two further targets within the Mount Vernon Project where strong late-time airborne EM anomalies are seen within and/or underneath the northernmost dolerite sill.

Mount Vernon Project showing airborne EM anomalies and ground EM targets.

The company highlights the following evidence, in addition to the EM results, that the dolerite sill has undergone differentiation and could therefore host nickel, copper and PGE sulphide mineralisation:

- Variation in grain size from very fine-grained chill margins at the extremities to coarser-grained gabbro in the centre of the sill;

- Increasing magnesium oxide, nickel and PGE results towards the bottom (northern margin) of the sill; and

- Nickel-chromium-titanium ratios suggest the presence of mafic cumulate rocks which are an important component of this style of mineralisation.

Miramar executive chairman Allan Kelly said the company believed the Bangemall Project had the potential for a style of nickel, copper and PGE mineralisation not previously seen in Western Australia.

The mineralisation at Bangemall is related to 1070Ma-aged Kulkatharra Dolerite sills, part of the Warakurna Large Igneous Province and the same age as the large Nebo-Babel nickel-copper deposits in the West Musgraves.

Working towards first drill

“We are the first company to explore for this style of mineralisation in the Bangemall region and are systematically progressing our targets towards the maiden drilling program,” said Kelly.

“At Mount Vernon, we identified multiple targets from our airborne EM survey and have now confirmed two of these with ground EM surveys and rock chip sampling.

“It is worth noting that, in contrast to many existing WA nickel deposits, the style of mineralisation we are looking for in the Bangemall occurs as large and very valuable orebodies that are basically immune to short-term swings in the nickel price.

“Like the discovery of Nebo-Babel in 2000, or Nova-Bollinger in 2012, if we can show proof of concept of the Norilsk-style deposit model at Mount Vernon and/or Trouble Bore, it opens up the entire Bangemall region as a new nickel-copper province, one where we have built a dominant landholding.”

Shallow EM conductor confirmed

Geophysical contractors completed a reconnaissance moving loop electromagnetic (MLEM) survey over the 3-kilometre-long historic late-time SkyTEM anomaly at the recently granted Trouble Bore target. They have since taken a short break due to extreme weather in the region.

The SkyTEM anomaly occurs at the intersection of a dolerite sill and a potential north-south trending feeder dyke, both of which are mostly buried beneath later sediments.

Evidence of the dolerite sill is seen in outcrop along strike in either direction. A reverse circulation hole drilled in 2013 targeted channel iron deposits and did not intersect the dolerite sill or test the SkyTEM anomaly. There is no recorded historical geochemical sampling in the area.

The recent MLEM survey confirmed the historic SkyTEM anomaly, with subsequent modelling suggesting a shallow, sub-horizontal conductor with a moderate conductance of around 200 Siemens.

Given the interpreted geological setting of the EM anomaly compared with known nickel-copper-PGE deposits, Miramar has submitted a program of work (POW) application for drilling at Trouble Bore.

The company already has POW approval for drilling at Mount Vernon and will apply for co-funding under the WA Government’s Exploration Incentive Scheme (EIS) for drilling at both Mount Vernon and Trouble Bore.

Trouble Bore Target (NYSE:TGT) showing SkyTEM and MLEM anomalies at intersection of dolerite sill and interpreted feeder dyke under cover.

Planned work

Initially, Miramar is aiming to show “proof of concept” of its Bangemall deposit model by identifying nickel-copper sulphide mineralisation.

Work planned to achieve this includes:

- Completion of ground EM surveys over selected airborne EM anomalies at Mount Vernon and Trouble Bore, which is now underway;

- Application for funding under the WA Government’s Exploration Incentive Scheme;

- Submitting a program of work application for drilling at Trouble Bore;

- Systematic rock chip sampling of outcropping dolerite sills;

- Reverse circulation drill testing;

- Progressing existing tenement applications to grant;

- Identifying other prospective areas to peg and/or acquire; and

- Discussions with potential joint venture partners.