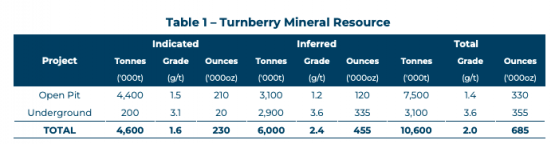

Meeka Metals Ltd (ASX:MEK) has updated the mineral resource estimate (MRE) for the shallow, high-grade Turnberry deposit within the 100%-owned Murchison Gold Project in Western Australia by 12% to 10.6 million tonnes at 2.0 g/t gold for 685,000 ounces.

This update has, in turn, raised the MRE for the entire Murchison Project to 12.4 million tonnes at 3.0 g/t gold for 1.2 million ounces.

The updated MRE, prepared by independent technical experts RSC, was based on 80,949 metres of drilling at Turnberry so far, including 5,952 metres of diamond drilling.

About 16,213 metres of the drilling, including 2,065 metres of diamond drilling, were completed between the October 30, 2022, cut-off date and the previous Turnberry MRE update in the June 2021 quarter.

Pre-feasibility study in June

A further 21 drill holes for 1,810 metres have been completed post the cut-off date and will be included in subsequent updates.

About 64% of the deposit is reported in the indicated classification and will form an important part of the pre-feasibility study, which is targeted for release in June this year.

Turnberry has a strike length of 1.7 kilometres and its near-surface open pit is largely drilled out with 20 by 20 metres hole spacing.

However, the deposit remains open to the north, south and at depth, which means there is a potential for underground mining to extend beyond the initial open pit.

Extending strike

Meeka’s managing director Tim Davidson said: “Drilling over the last 18 months has targeted the high-grade core of Turnberry, in addition to expanding the shallow oxide gold on the western flank. The majority of the open pit constrained mineral resource is now in indicated as we move toward mining.

“In addition, the open pit optimisation used to constrain the mineral resource reflects recent mining cost escalation in the industry. This approach has reduced the size of the open pit portion of the mineral resource, which now stands at about 330,000 ounces.

"Cost escalation was mitigated somewhat through the addition of shallow oxide gold on the western flank which falls within the pit optimisation.

“Planning is in place to further extend the strike of this shallow gold in 2023. Extensional drilling also commenced on the eastern flank in December 2022 - assays pending - where an opportunity to further grow the shallow oxide gold at Turnberry was identified.”

Long section showing Turnberry MRE.

Other Meeka projects

In addition to the Murchison Gold Project, Meeka owns the Circle Valley Project covering 222 square kilometres in the Albany-Fraser Mobile Belt in Western Australia.

Gold mineralisation has been identified in four separate locations at Circle Valley, which Meeka is pursuing aggressively.

The exploration company also controls the Cascade Rare Earths Project totalling 2,269 square kilometres, with results to date showing high levels of neodymium and praseodymium, both magnet materials.

As these metals are geopolitically critical, the company intends to accelerate its understanding of Cascade through metallurgical work and ongoing drilling.

Circle Valley also hosts clay rare earths within thick, near-surface mineralised zones below shallow transported cover, consistent with neodymium-praseodymium oxides.

Metallurgical work, in addition to infill and extensional drilling, is ongoing, with an initial MRE targeted for 2023.

Read more on Proactive Investors AU